Why The APCO Credit Union Is Your Go-To Financial Partner

Let’s face it, folks—when it comes to managing your money, you want a partner who truly has your back. APCO Credit Union isn’t just another bank; it’s a community-driven financial institution that puts members first. Whether you're looking to save, borrow, or grow your wealth, APCO Credit Union offers personalized solutions tailored to fit your needs. And hey, in a world where big banks can feel impersonal, this credit union is all about connection, trust, and empowerment.

Imagine walking into a financial institution where they know your name, understand your goals, and genuinely care about helping you succeed. That’s exactly what APCO Credit Union brings to the table. With a focus on member satisfaction and competitive rates, it’s no wonder so many people are turning to this credit union for their financial needs.

But don’t just take our word for it—stick around as we dive deep into why APCO Credit Union stands out in today’s financial landscape. From its rich history to its modern offerings, we’ll explore everything you need to know about making APCO your financial home.

Read also:Unlocking The Secrets Of A Doctor Of Credit Your Ultimate Guide

Ready to learn more? Let’s get started!

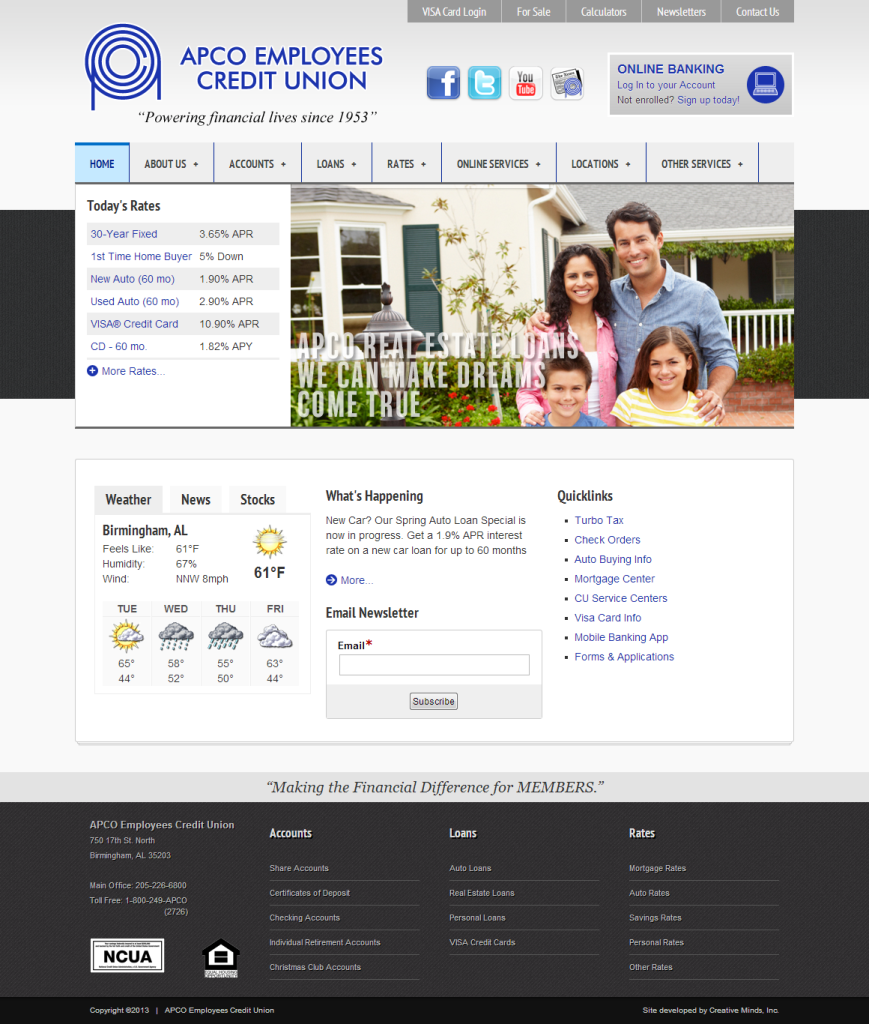

What Exactly is APCO Credit Union?

APCO Credit Union, short for Associated Public Colleges Officers Credit Union, is a member-owned financial cooperative that operates with one simple mission: to provide affordable financial services to its members. Unlike traditional banks, credit unions like APCO are not-for-profit organizations, meaning any profits earned are reinvested back into the institution to benefit its members.

This unique structure allows APCO Credit Union to offer lower interest rates on loans, higher dividends on savings accounts, and fewer fees overall. It’s all about creating value for the people who matter most—the members. So, whether you’re looking to open a checking account, apply for a mortgage, or even plan for retirement, APCO Credit Union has got you covered.

Understanding the Benefits of Joining APCO Credit Union

Now, let’s break down why joining APCO Credit Union could be one of the smartest financial decisions you’ll ever make. Here’s a quick rundown of the top benefits:

- Lower Loan Rates: Need a car loan or a personal loan? APCO Credit Union typically offers lower interest rates compared to traditional banks.

- Higher Savings Rates: Want to grow your nest egg? Their savings accounts and certificates of deposit (CDs) often come with better returns.

- Personalized Service: Forget about being just another customer number. APCO Credit Union prides itself on delivering personalized attention to each member.

- Community Focus: As a not-for-profit institution, APCO reinvests its earnings into the community, supporting local initiatives and charities.

- No Hidden Fees: Tired of unexpected charges? APCO Credit Union strives to keep things transparent, so you always know what you’re paying for.

A Brief History of APCO Credit Union

To truly appreciate APCO Credit Union, it helps to understand its roots. Established in [year], APCO was originally founded to serve employees of public colleges and universities. Over the years, however, the credit union has expanded its field of membership to include a wider range of individuals and families.

From humble beginnings, APCO Credit Union has grown into a trusted financial institution with branches across multiple locations. Despite its growth, the credit union has remained committed to its core values of integrity, community, and member empowerment. This unwavering dedication is one of the reasons why APCO continues to thrive in an ever-changing financial world.

Read also:Eagle Cam Big Bear Your Ultimate Guide To Witnessing Natures Majesty

Who Can Join APCO Credit Union?

One common question people have is whether they qualify to join APCO Credit Union. The good news? The eligibility criteria are broader than you might think. Here’s who can become a member:

- Employees of public colleges, universities, and related organizations

- Retirees or dependents of eligible employees

- Residents of specific counties or regions served by APCO

- Non-profit organizations and businesses within the credit union’s service area

Even if you don’t meet these criteria directly, there may still be ways to join through affiliations or community programs. Contact APCO Credit Union directly to find out if you’re eligible!

APCO Credit Union vs. Traditional Banks

So, how does APCO Credit Union stack up against traditional banks? Let’s compare the two:

Key Differences

Traditional banks are for-profit institutions, meaning their primary goal is to generate revenue for shareholders. Credit unions, on the other hand, operate as not-for-profit cooperatives, focusing on serving their members rather than maximizing profits.

Here’s a side-by-side comparison:

- Ownership: Banks are owned by shareholders, while credit unions are owned by their members.

- Interest Rates: Credit unions generally offer lower loan rates and higher savings rates.

- Customer Service: Credit unions often provide more personalized service due to their smaller size and community focus.

- Fees: Credit unions tend to charge fewer fees and are more transparent about them.

While both options have their pros and cons, APCO Credit Union’s member-centric approach makes it a compelling choice for those seeking a more personal banking experience.

Financial Products Offered by APCO Credit Union

Now that you know what sets APCO Credit Union apart, let’s talk about the financial products and services they offer. Whether you’re saving for the future, buying a home, or managing everyday expenses, APCO has something for everyone.

Savings Accounts

APCO Credit Union offers several types of savings accounts designed to help you reach your financial goals:

- Regular Savings: A basic account with no minimum balance requirement and competitive interest rates.

- Money Market Accounts: Higher-yield accounts for larger balances, offering greater earning potential.

- Certificates of Deposit (CDs): Fixed-term investments with guaranteed returns.

Checking Accounts

For your day-to-day transactions, APCO provides convenient checking options:

- Free Checking: No monthly fees and unlimited transactions.

- Premium Checking: Additional perks like higher interest rates and waived ATM fees.

Loans and Mortgages

Need to borrow money? APCO Credit Union offers a variety of loan products at competitive rates:

- Auto Loans: Financing for new and used vehicles.

- Mortgages: Home loans with flexible terms and low interest rates.

- Personal Loans: Unsecured loans for various purposes, such as debt consolidation or home improvements.

How APCO Credit Union Supports the Community

One of the most admirable aspects of APCO Credit Union is its commitment to giving back. Through partnerships with local organizations and charitable initiatives, APCO actively supports causes that matter to its members and the broader community.

Some of their notable contributions include:

- Funding scholarships for students pursuing higher education

- Providing financial literacy workshops to empower individuals with knowledge

- Supporting local food banks and shelters during times of need

By choosing APCO Credit Union, you’re not only securing your financial future but also contributing to meaningful community efforts.

Tips for Maximizing Your APCO Credit Union Experience

Ready to make the most of your membership? Here are a few tips to help you get the most out of APCO Credit Union:

Stay Informed

Sign up for newsletters and alerts to stay updated on new products, promotions, and important announcements. Knowledge is power, after all!

Utilize Online Banking

Take advantage of APCO’s robust online banking platform to manage your accounts, pay bills, and monitor transactions from anywhere.

Set Financial Goals

Work with a financial advisor at APCO to create a personalized plan that aligns with your long-term objectives, whether it’s buying a house, starting a business, or planning for retirement.

Common Questions About APCO Credit Union

Before we wrap up, let’s address some frequently asked questions about APCO Credit Union:

Is APCO Credit Union FDIC-Insured?

No, but here’s the good news—APCO Credit Union is insured by the National Credit Union Administration (NCUA), which provides coverage up to $250,000 per account.

What Are APCO Credit Union’s Hours of Operation?

Branch hours vary, but most locations are open Monday through Friday, with some offering extended hours or Saturday availability. Always check their website for the most accurate information.

How Do I Apply for Membership?

Applying for membership is easy! Simply visit an APCO Credit Union branch, call their customer service line, or complete the application process online.

Conclusion

In conclusion, APCO Credit Union offers a refreshing alternative to traditional banking, combining competitive financial products with a strong commitment to community and member satisfaction. Whether you’re looking to save, borrow, or grow your wealth, APCO has the tools and resources to help you succeed.

So, what are you waiting for? Join APCO Credit Union today and experience the difference that comes with being part of a member-owned cooperative. Don’t forget to share this article with friends and family who might benefit from learning about APCO Credit Union—and feel free to leave a comment below sharing your thoughts!

Table of Contents

- What Exactly is APCO Credit Union?

- Understanding the Benefits of Joining APCO Credit Union

- A Brief History of APCO Credit Union

- Who Can Join APCO Credit Union?

- APCO Credit Union vs. Traditional Banks

- Financial Products Offered by APCO Credit Union

- How APCO Credit Union Supports the Community

- Tips for Maximizing Your APCO Credit Union Experience

- Common Questions About APCO Credit Union

- Conclusion

Article Recommendations