Why Putting All Your Eggs In One Basket Is Risky But Sometimes Smart

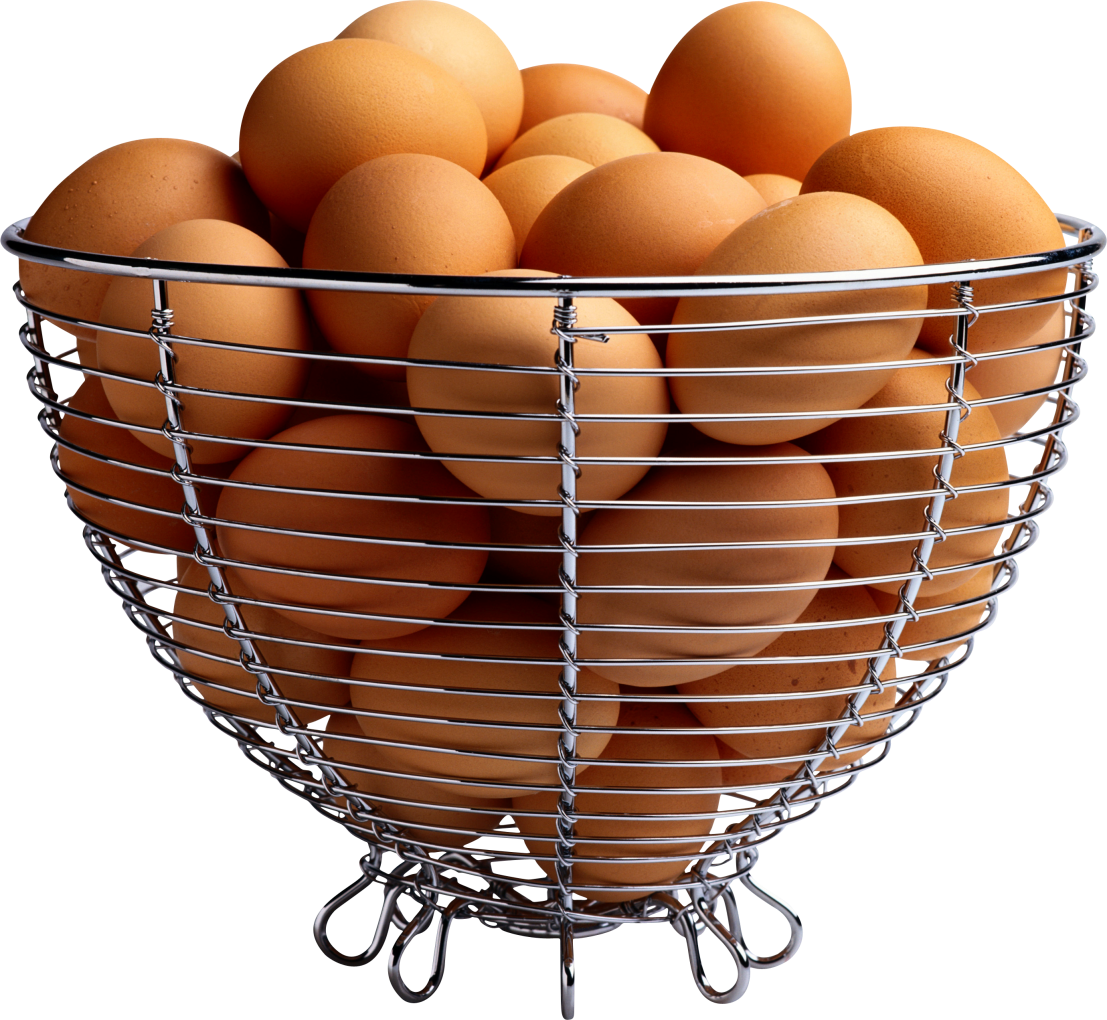

Imagine you're standing at a farmer's market, holding a basket full of fresh eggs. You carefully balance it, but one wrong move could send them all crashing to the ground. Now, think about your life—your finances, your career, or even your relationships. Are you putting all your eggs in one basket? It’s a metaphor we’ve all heard before, but what does it really mean, and is it always bad? Let’s dive into why this age-old saying still holds weight today.

Putting all your eggs in one basket has become a popular saying for good reason. It warns us against concentrating all our resources or efforts into a single venture. Whether it’s investing all your money in one stock or relying on a single income source, the risks are clear. But is it always a bad idea? Not necessarily. Sometimes, focusing all your energy on one thing can lead to great rewards.

In this article, we’ll explore the pros and cons of putting all your eggs in one basket. We’ll break down real-life examples, offer practical advice, and help you decide whether this strategy works for you. So grab your metaphorical basket, and let’s get started!

Read also:How Tall Is Sylvester Stallone Unveiling The Real Height Of The Action Legend

Table of Contents

- What Does "Eggs in One Basket" Mean?

- The History of the Saying

- Risks of Putting All Your Eggs in One Basket

- When It Works: Scenarios Where This Strategy Pays Off

- From an Investment Perspective

- In the Context of Your Career

- Personal Relationships: A Unique Take

- Alternatives to Diversification

- How to Balance Risk and Reward

- Final Thoughts on Eggs in a Basket

What Does "Eggs in One Basket" Mean?

Let’s start with the basics. The phrase “putting all your eggs in one basket” means concentrating all your resources, efforts, or hopes into a single venture. Think of it as betting everything on one horse in a race. If that horse wins, you’re golden. But if it doesn’t… well, you’re out of luck.

But here’s the kicker—this saying isn’t just about money. It applies to almost every area of life. For instance:

- Investing all your savings into one stock.

- Focusing all your career efforts on one job or company.

- Placing all your emotional energy into one relationship.

While it sounds simple, the implications can be huge. Let’s break it down further.

The History of the Saying

Ever wondered where this saying came from? The origins of “eggs in one basket” date back centuries. Some historians trace it to ancient proverbs, while others link it to agricultural practices. Farmers, for example, knew the dangers of carrying all their eggs in one basket—if they dropped it, they’d lose everything.

Over time, the saying evolved to symbolize risk management. By the 18th century, it had entered common usage in English-speaking countries. Today, it’s a staple in conversations about finance, business, and personal development.

Why Has It Stood the Test of Time?

Simple: it resonates. People understand the concept intuitively. Whether you’re managing a multimillion-dollar portfolio or deciding which college to attend, the idea of spreading risk versus focusing your efforts is universal.

Read also:Unlocking The Role Of The Ok Secretary Of State A Deep Dive

Risks of Putting All Your Eggs in One Basket

Now, let’s talk risks. If you’ve ever dropped a glass or tripped over your own feet, you know how quickly things can go wrong. The same applies when you put all your eggs in one basket. Here are some common risks:

- Financial Loss: If you invest all your money in one stock and it crashes, you’re out of luck.

- Emotional Burnout: Pouring all your energy into one relationship or project can leave you exhausted if things don’t work out.

- Opportunity Cost: By focusing on one thing, you might miss out on other opportunities that could lead to greater success.

These risks aren’t theoretical. They’ve happened to countless people throughout history. Take the dot-com bubble, for example. Many investors poured all their money into tech startups, only to lose everything when the market crashed.

Real-Life Examples

One famous example is the Enron scandal. Employees invested heavily in company stock, believing it was a sure thing. When Enron collapsed, many lost their life savings. It’s a harsh reminder of why diversification matters.

When It Works: Scenarios Where This Strategy Pays Off

But wait—before you swear off this strategy entirely, consider this: sometimes, putting all your eggs in one basket can pay off big time. Think of entrepreneurs like Elon Musk or Steve Jobs. They bet everything on their vision, and it worked.

Here are a few scenarios where this approach might make sense:

- High-Reward Ventures: If you have a solid plan and the potential rewards outweigh the risks, going all-in might be worth it.

- Focus and Commitment: Sometimes, spreading yourself too thin leads to mediocrity. Focusing on one thing can help you excel.

- Passion Projects: If you’re deeply passionate about something, throwing everything into it might lead to success.

How to Know if It’s Right for You

Ultimately, it depends on your situation. Ask yourself: Can I afford to lose everything if this doesn’t work out? If the answer is yes, go for it. But if not, proceed with caution.

From an Investment Perspective

When it comes to investing, diversification is king. Financial experts will tell you to spread your investments across different asset classes. But what if you believe in one company so strongly that you’re willing to bet everything on it?

Take Warren Buffett, for example. He’s known for his concentrated investment strategy. He doesn’t spread his money thinly—he picks a few great companies and sticks with them. It’s worked wonders for him, but it’s not without risks.

Tips for Investors

If you’re considering this approach, here are a few tips:

- Do your research. Know the company inside and out.

- Have a contingency plan. What will you do if things go south?

- Be prepared for volatility. The ride might be bumpy, but the rewards could be worth it.

In the Context of Your Career

Your career is another area where this saying applies. Should you focus all your efforts on one job or company, or should you keep your options open? The answer depends on your goals and circumstances.

For example, if you’re climbing the corporate ladder, focusing on one company might help you advance faster. But if you’re in a field with high turnover, diversifying your skills and experiences might be smarter.

Building a Safety Net

Regardless of your approach, it’s always wise to build a safety net. This could mean saving money, developing multiple skills, or networking with professionals in different industries. That way, if one basket breaks, you still have others to fall back on.

Personal Relationships: A Unique Take

Let’s not forget relationships. Putting all your eggs in one basket can apply here too. Should you invest all your emotional energy into one person, or should you keep your options open?

There’s no one-size-fits-all answer. Some people thrive in committed, monogamous relationships, while others prefer more open arrangements. The key is to communicate openly and honestly with your partner(s).

Setting Boundaries

Whether you’re in a monogamous relationship or not, setting boundaries is crucial. Know what you’re willing to give and what you expect in return. This applies to friendships, family relationships, and romantic partnerships alike.

Alternatives to Diversification

Not everyone is a fan of diversification. Some argue that spreading yourself too thin leads to mediocrity. If you’re considering an alternative approach, here are a few options:

- Focus on One Goal: Pour all your energy into achieving one specific goal.

- Build a Support System: Surround yourself with people who can help you succeed.

- Stay Adaptable: Be ready to pivot if things don’t go as planned.

Ultimately, the key is balance. You don’t have to choose between all-in or diversification. Find a middle ground that works for you.

How to Balance Risk and Reward

So, how do you balance risk and reward when putting all your eggs in one basket? Here are a few strategies:

- Do Your Homework: Research thoroughly before making any big decisions.

- Set Realistic Expectations: Don’t expect overnight success. Be patient and persistent.

- Have a Backup Plan: Always know what you’ll do if things don’t work out.

Remember, there’s no such thing as a risk-free strategy. But with careful planning and execution, you can minimize the downsides while maximizing the upsides.

Final Thoughts on Eggs in a Basket

Putting all your eggs in one basket is risky, but it’s not always a bad idea. Whether you’re investing, managing your career, or navigating relationships, the key is balance. Know the risks, weigh the rewards, and make informed decisions.

So, what’s your take? Are you a diversification enthusiast or an all-in kind of person? Let me know in the comments below. And if you found this article helpful, don’t forget to share it with your friends!

Until next time, stay sharp and keep your eggs safe!

Article Recommendations