Altra Credit Union: Your Trusted Financial Partner For Smart Money Management

Welcome to the world of Altra Credit Union, where banking meets community values. If you're looking for a financial institution that truly understands your needs and offers personalized services, this is the place to be. Altra Credit Union isn't just another bank; it's your partner in achieving financial freedom. Whether you're planning for retirement, buying a home, or simply managing day-to-day expenses, Altra has got your back.

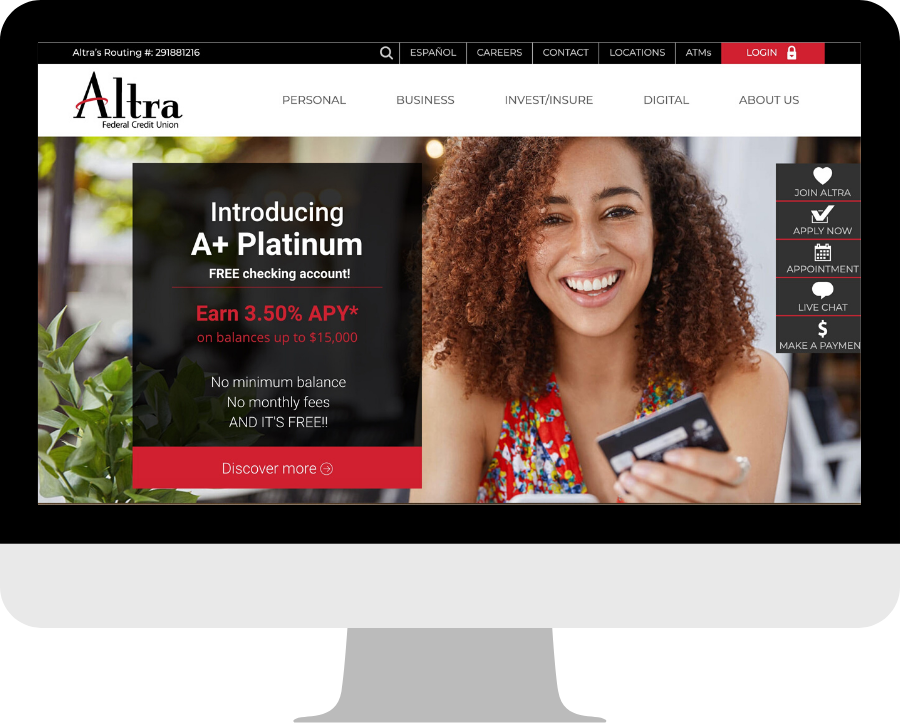

In today's fast-paced world, finding a reliable financial partner can feel overwhelming. But with Altra Credit Union, you don't have to worry about hidden fees or complicated terms. They offer a wide range of products and services tailored to meet your unique financial goals. From competitive loan rates to high-yield savings accounts, Altra ensures that every member gets the best deal possible.

What makes Altra Credit Union stand out from traditional banks? It's their member-focused approach. Unlike banks, credit unions operate as not-for-profit organizations, meaning any profits earned are reinvested into member benefits. This commitment to serving members first sets Altra apart and makes it an ideal choice for those seeking transparency and trust in their financial services.

Read also:Discover The Flavorful World Of Taqueria La Herradura

Understanding Altra Credit Union: A Brief Overview

Before we dive deep into what Altra Credit Union offers, let's take a moment to understand its roots and mission. Established in [insert year], Altra has grown to become one of the most respected credit unions in the region. Their primary goal is to empower members by providing exceptional financial products and services while fostering a sense of community.

As a member-owned cooperative, Altra operates on the principle of "people helping people." This means that every decision made within the organization prioritizes the well-being of its members over profits. It's no wonder why so many individuals and families have chosen Altra as their go-to financial institution.

Why Choose Altra Credit Union Over Traditional Banks?

When comparing Altra Credit Union to traditional banks, there are several key advantages worth noting:

- No hidden fees - Altra believes in complete transparency when it comes to pricing.

- Higher interest rates on savings - Members enjoy better returns on their deposits compared to most banks.

- Lower loan rates - Altra consistently offers competitive rates on mortgages, auto loans, and personal loans.

- Personalized service - Each member receives individual attention and support tailored to their specific needs.

- Community involvement - Altra actively participates in local initiatives and supports charitable causes.

These benefits make Altra Credit Union an attractive option for anyone looking to manage their finances more effectively while staying connected to their community.

Membership Requirements: Who Can Join Altra Credit Union?

One common question people ask is, "Who qualifies to join Altra Credit Union?" The good news is that eligibility criteria are quite inclusive. To become a member, you must meet one of the following requirements:

- Live, work, worship, or attend school in [list of eligible counties/cities].

- Be a family member of an existing Altra member.

- Join a partner organization affiliated with Altra.

Once you meet these criteria, joining is as simple as opening a share savings account with a minimum deposit of $5. From there, you'll gain access to all the amazing benefits and services offered by Altra Credit Union.

Read also:Canton Police Department Your Ultimate Guide To Safety And Security

What Happens After You Become a Member?

Becoming a member of Altra Credit Union opens up a world of possibilities. You'll have access to:

- Checking and savings accounts with no monthly fees.

- Free online banking and mobile apps for convenient account management.

- Low-rate loans for homes, cars, and other major purchases.

- Financial education resources to help you make smarter money decisions.

- Access to shared branching and CO-OP network ATMs nationwide.

With so many perks, it's no wonder why so many people choose Altra Credit Union as their primary financial institution.

Savings Accounts: Grow Your Money Wisely

Saving money is an essential part of financial planning, and Altra Credit Union makes it easy with their variety of savings options:

- Regular Savings Account: Earn dividends while maintaining easy access to your funds.

- Money Market Accounts: Enjoy higher dividend rates on larger balances.

- Certificates of Deposit (CDs): Lock in competitive rates for a set term.

- IRA Accounts: Plan for retirement with tax-advantaged savings options.

Each account type is designed to help you achieve different financial milestones, whether it's building an emergency fund, saving for a vacation, or securing your future through retirement planning.

Tips for Maximizing Your Savings

Here are some practical tips to help you get the most out of your savings account at Altra Credit Union:

- Set specific savings goals and track your progress regularly.

- Automate transfers from your checking account to your savings account.

- Take advantage of promotional rates and special offers when available.

- Review your account statements monthly to ensure accuracy.

By following these strategies, you'll be well on your way to growing your wealth and achieving financial security.

Loan Products: Financing Made Easy

Whether you're buying a new car, refinancing your mortgage, or consolidating debt, Altra Credit Union offers a wide range of loan products to suit your needs:

- Auto Loans: Competitive rates on new and used vehicles.

- Mortgage Loans: Flexible terms and low down payment options.

- Personal Loans: Quick access to funds for unexpected expenses.

- Home Equity Loans: Tap into your home's equity for major projects.

What sets Altra apart is their commitment to helping members find the right loan solution without unnecessary pressure or complicated processes.

How to Apply for a Loan at Altra Credit Union

The application process at Altra Credit Union is straightforward and convenient:

- Visit their website or stop by a branch to start your application.

- Gather necessary documents, such as proof of income and identification.

- Work with a loan officer to determine the best product for your situation.

- Complete the application and await approval, often within days.

With Altra, you can expect fast service and fair terms that align with your financial goals.

Online Banking: Convenience at Your Fingertips

In today's digital age, having access to your accounts anytime, anywhere is crucial. Altra Credit Union understands this need and provides robust online banking features:

- View account balances and transaction history.

- Transfer funds between accounts.

- Pay bills and set up recurring payments.

- Deposit checks using your smartphone.

These tools make managing your finances more efficient and hassle-free than ever before.

Staying Safe Online

Security is a top priority at Altra Credit Union. To protect your information:

- Use strong, unique passwords for your accounts.

- Enable multi-factor authentication whenever possible.

- Monitor your accounts regularly for unauthorized activity.

- Report any suspicious transactions immediately.

By taking these precautions, you can enjoy peace of mind while using Altra's online services.

Financial Education: Empowering Members for Success

At Altra Credit Union, they believe that knowledge is power. That's why they offer numerous resources to help members improve their financial literacy:

- Free workshops and seminars on budgeting, investing, and credit management.

- Online articles and guides covering various financial topics.

- One-on-one consultations with financial advisors.

By equipping members with the tools they need to succeed financially, Altra ensures that everyone has the opportunity to thrive.

Building a Brighter Financial Future

Investing in your financial education is one of the best things you can do for yourself. With Altra Credit Union's support, you'll gain the confidence and skills needed to make informed decisions about your money.

Community Involvement: Giving Back Where It Matters Most

Altra Credit Union isn't just about banking; it's about making a difference in the communities they serve. Through partnerships with local organizations and charitable donations, Altra actively contributes to causes that improve lives and strengthen neighborhoods.

How You Can Get Involved

As a member, you can participate in community events hosted by Altra Credit Union or volunteer your time to support their initiatives. Together, we can create positive change and build a brighter future for all.

Conclusion: Why Altra Credit Union Is Right for You

In summary, Altra Credit Union offers a comprehensive suite of financial products and services designed to help you achieve your goals. From competitive loan rates to high-yield savings accounts, they provide everything you need to manage your money wisely.

So what are you waiting for? Join the thousands of satisfied members who trust Altra Credit Union with their financial needs. Visit their website or stop by a branch today to learn more and start your journey toward financial success.

Don't forget to share this article with friends and family who might benefit from knowing about Altra Credit Union. And if you have any questions or feedback, feel free to leave a comment below. Let's keep the conversation going and help each other grow financially!

Table of Contents

- Understanding Altra Credit Union: A Brief Overview

- Why Choose Altra Credit Union Over Traditional Banks?

- Membership Requirements: Who Can Join Altra Credit Union?

- Savings Accounts: Grow Your Money Wisely

- Loan Products: Financing Made Easy

- Online Banking: Convenience at Your Fingertips

- Financial Education: Empowering Members for Success

- Community Involvement: Giving Back Where It Matters Most

- Conclusion: Why Altra Credit Union Is Right for You

Article Recommendations