Partner Colorado Credit Union: Your Ultimate Financial Ally In The Rocky Mountains

Welcome to the world of credit unions, where community banking meets personalized service! If you're searching for a financial partner that truly understands your needs, look no further than Colorado Credit Union. As one of the leading credit unions in the state, it offers more than just banking services—it's about building lasting relationships with its members. Whether you're looking to save, borrow, or grow your wealth, Colorado Credit Union has got your back. So, let's dive into why partnering with this credit union could be the best financial decision you'll ever make!

When it comes to managing your finances, trust is everything. And that's exactly what Colorado Credit Union brings to the table. Unlike traditional banks, credit unions operate as not-for-profit organizations, meaning they prioritize their members' financial well-being over profits. This unique structure ensures that every decision made is in your best interest. From competitive loan rates to exceptional customer service, Colorado Credit Union stands out as a true partner in your financial journey.

But what exactly makes Colorado Credit Union so special? Well, buckle up because we're about to break it down for you. In this article, we'll explore everything you need to know about partnering with Colorado Credit Union, from its history and services to the benefits of becoming a member. By the end of this read, you'll have all the tools you need to make an informed decision about your financial future. Let's get started!

Read also:Before We Were Yours A Heartbreaking Story That Touched Millions

Here's a quick roadmap to help you navigate this article:

- The History of Colorado Credit Union

- Becoming a Member

- Services Offered

- Benefits of Partnering

- Loan Options

- Savings Accounts

- Community Involvement

- Tech-Savvy Solutions

- Security Features

- The Future of Colorado Credit Union

The Story Behind Colorado Credit Union

Let's rewind for a sec and talk about where it all began. Colorado Credit Union wasn't always the financial powerhouse it is today. Established back in the day, this credit union started as a small operation with a big dream—to provide affordable banking services to the local community. Over the years, it has grown exponentially, expanding its reach and offerings to meet the evolving needs of its members.

What sets Colorado Credit Union apart is its commitment to staying true to its roots. Even as it has grown, the credit union has maintained its focus on personalized service and community engagement. This dedication to its members is what has allowed it to thrive in an ever-changing financial landscape. So, whether you're a long-time member or just considering joining, you can rest assured that you're in good hands.

Why Credit Unions Are the Real MVPs

Okay, so why are credit unions like Colorado Credit Union such a big deal? Well, for starters, they're owned by their members, which means you have a say in how things are run. This member-centric approach ensures that the credit union operates in a way that benefits everyone involved. Plus, since they're not-for-profit, any profits earned are reinvested back into the credit union, resulting in lower fees and better rates for members.

Becoming a Member: The Lowdown

Alright, let's talk about how you can become part of the Colorado Credit Union family. First things first, you'll need to meet the eligibility requirements. Typically, this means living, working, or worshipping in the state of Colorado. But don't worry, the credit union's field of membership is pretty broad, so chances are you qualify.

Once you've confirmed your eligibility, signing up is a breeze. You can join online, over the phone, or in person at one of their conveniently located branches. All you need is a government-issued ID and a small deposit to open your first account. Easy peasy, right? Plus, as a new member, you'll have access to a whole host of benefits, including exclusive offers and promotions.

Read also:Happy Birthday Daughter Images The Ultimate Guide To Celebrating Your Little Princess

What You Get as a Member

- Competitive interest rates on loans and savings accounts

- Free or low-cost banking services

- Access to a network of shared branching locations

- State-of-the-art online banking tools

- Personalized financial advice and counseling

Services That Keep You Covered

Now that you're a member, let's talk about the services Colorado Credit Union offers. From everyday banking to complex financial planning, they've got you covered. Here's a rundown of some of the key services you can expect:

- Checking and savings accounts

- Personal and business loans

- Credit cards with rewards programs

- Mortgage and home equity loans

- Investment and retirement planning

But wait, there's more! Colorado Credit Union also offers educational resources to help you make informed financial decisions. Whether you're looking to improve your credit score or save for a big purchase, they've got the tools and expertise to guide you every step of the way.

Why Choose Colorado Credit Union Over Traditional Banks?

Here's the deal: credit unions like Colorado Credit Union offer many of the same services as traditional banks, but with a few key differences. For starters, their fees are typically lower, and their interest rates are more competitive. Plus, as a member, you're not just a customer—you're a shareholder. That means you have a say in how the credit union is run and can benefit from its success.

Benefits of Partnering with Colorado Credit Union

So, what exactly do you gain by partnering with Colorado Credit Union? Let us count the ways. First and foremost, you get access to personalized service that's hard to find at larger banks. Whether you're dealing with a banking issue or need advice on a financial decision, you can count on the credit union's team of experts to be there for you.

Another major benefit is the credit union's commitment to financial education. They believe that informed members are empowered members, which is why they offer a wide range of resources to help you improve your financial literacy. From workshops and webinars to one-on-one counseling, they've got everything you need to take control of your finances.

Member Perks That Keep on Giving

- Exclusive discounts on products and services

- Referral bonuses for bringing in new members

- Special promotions and events throughout the year

- Access to a network of over 5,000 shared branching locations

Loan Options That Fit Your Needs

Let's talk about loans because, let's face it, at some point in life, most of us will need one. Colorado Credit Union offers a variety of loan options to suit different financial needs. Whether you're looking to buy a car, remodel your home, or consolidate debt, they've got a loan product that's right for you.

One of the biggest advantages of borrowing from Colorado Credit Union is the competitive interest rates. Since they're not-for-profit, they can offer lower rates than traditional banks, which means more money in your pocket. Plus, their loan approval process is streamlined and hassle-free, so you can get the funds you need quickly and easily.

Popular Loan Products

- Auto loans with flexible terms

- Personal loans for any purpose

- Home equity loans and lines of credit

- Student loans with deferred payments

Savings Accounts That Help You Grow

Now let's shift gears and talk about saving. Colorado Credit Union offers a range of savings accounts designed to help you achieve your financial goals. Whether you're saving for a rainy day, a dream vacation, or retirement, they've got an account that's right for you.

One of the standout features of Colorado Credit Union's savings accounts is the competitive interest rates. They offer some of the highest rates in the industry, which means your money will grow faster than at most traditional banks. Plus, their accounts come with no hidden fees, so you can save with confidence.

Types of Savings Accounts

- Regular savings accounts for everyday savings

- Money market accounts for larger balances

- IRA accounts for retirement planning

- Certificate of deposit (CD) accounts for long-term savings

Community Involvement: Making a Difference

At its core, Colorado Credit Union is all about community. They believe that a strong community starts with strong individuals, which is why they invest heavily in local initiatives and programs. From sponsoring local events to supporting charitable organizations, they're committed to making a positive impact in the communities they serve.

One of the ways they give back is through their financial education programs. They partner with local schools and organizations to teach financial literacy to people of all ages. By empowering individuals with the knowledge and skills they need to succeed financially, they're helping to create a brighter future for everyone.

How You Can Get Involved

- Volunteer at community events sponsored by the credit union

- Participate in financial education workshops and seminars

- Donate to causes supported by the credit union

- Spread the word about the credit union's mission and values

Tech-Savvy Solutions for Modern Banking

Let's face it, in today's fast-paced world, convenience is key. That's why Colorado Credit Union offers a range of tech-savvy solutions to make banking easier than ever. From mobile banking apps to online bill pay, they've got everything you need to manage your finances on the go.

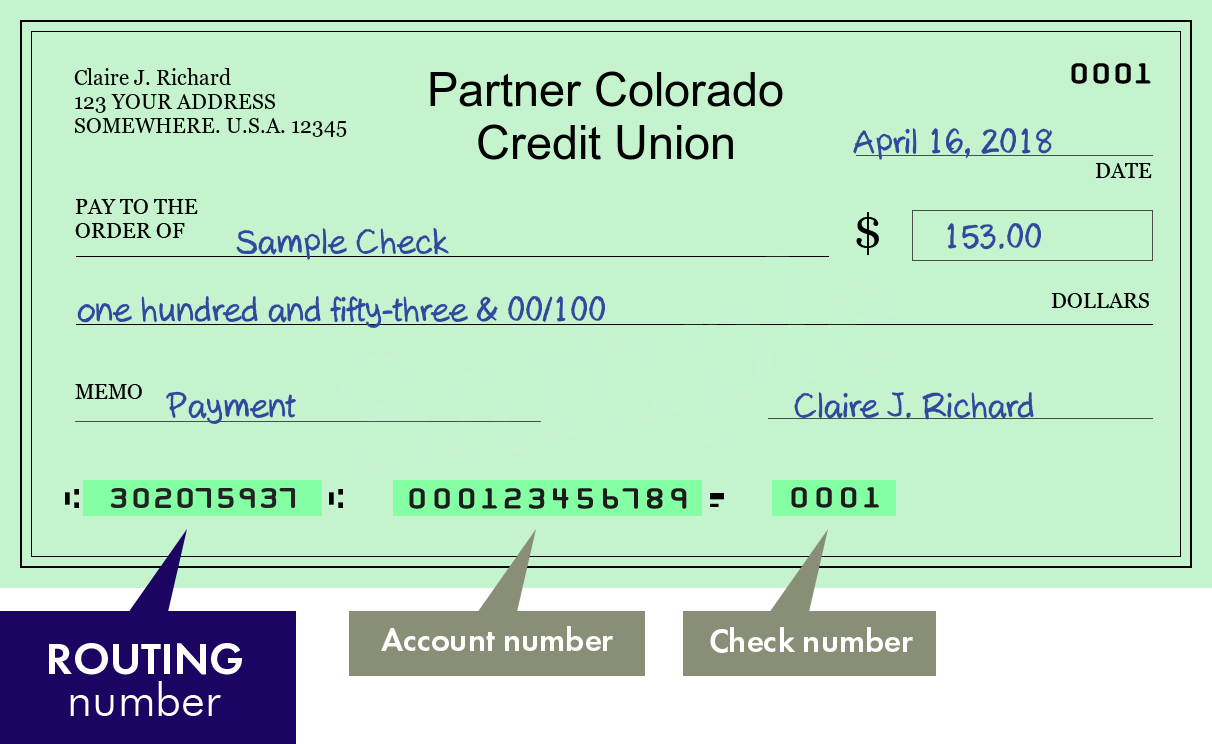

One of the coolest features of their mobile app is the ability to deposit checks remotely. Simply snap a picture of your check, upload it to the app, and you're good to go. No more trips to the branch or ATM necessary. Plus, their app offers real-time account updates, so you can keep track of your transactions wherever you are.

Must-Have Tech Features

- Mobile banking app with remote check deposit

- Online bill pay and account management

- 24/7 customer support via chat or phone

- Secure login with biometric authentication

Security Features That Protect Your Assets

When it comes to your money, security is non-negotiable. That's why Colorado Credit Union takes every precaution to ensure your accounts are safe and secure. They employ state-of-the-art encryption technology and multi-factor authentication to protect your personal and financial information.

In addition to these technical safeguards, they also offer fraud protection services to help you detect and prevent unauthorized transactions. If you suspect fraudulent activity on your account, their dedicated fraud team is available to assist you 24/7. Rest assured, your money is in good hands with Colorado Credit Union.

How to Stay Safe Online

- Create strong, unique passwords for your accounts

- Enable multi-factor authentication whenever possible

- Monitor your accounts regularly for suspicious activity

- Report any suspected fraud immediately

The Future of Colorado Credit Union

As we look to the future, one thing is certain: Colorado Credit Union will continue to innovate and evolve to meet the needs of its members. They're always exploring new ways to enhance their services and improve the member experience. From expanding their digital offerings to investing in cutting-edge technology, they're committed to staying ahead of the curve.

But it's not just about technology. Colorado Credit Union will continue to prioritize community engagement and financial education, ensuring that every member has the tools and resources they need to succeed. So, whether you're a long-time member or just joining, you can look forward to a bright future with Colorado Credit Union by your side.

What's Next for Members?

- New and improved digital banking tools

- Expanded financial education programs

- Increased community involvement and partnerships

- Enhanced security features and fraud protection

Final Thoughts: Why Partner Colorado Credit Union is the Way to Go

So, there you have it—everything you need to know about partnering with Colorado Credit Union. From its rich history and commitment to community to its wide range of services and benefits, it's clear that this credit union is

Article Recommendations