Oregon Tax Refund: Your Ultimate Guide To Getting The Money You Deserve!

Ever wondered how Oregon tax refund could be your ticket to a financial boost? Well, buckle up because we’re diving deep into everything you need to know about reclaiming your hard-earned cash. Oregon’s tax system might seem like a maze, but with the right info, you’ll navigate it like a pro. Let’s get started!

Taxes are a part of life, and let’s face it, sometimes they feel like they’re eating into your wallet faster than you can say "Oregon tax refund." But here’s the good news: you don’t have to sit back and watch your money disappear. Understanding how refunds work in Oregon can put some of that cash back in your pocket where it belongs. So, whether you’re a resident or just passing through, this guide is here to help you out.

From figuring out if you qualify for an Oregon tax refund to navigating the ins and outs of the filing process, we’ve got all the details covered. This isn’t just another boring tax article; think of it as your personal cheat sheet to reclaiming your money. Ready to learn how to turn those tax blues into greenbacks? Let’s go!

Read also:Crazy Days And Nights A Wild Journey Through Lifes Chaotic Adventures

Why Oregon Tax Refund Matters

When it comes to Oregon tax refund, it’s not just about getting money back—it’s about ensuring fairness in taxation. The state of Oregon operates under a system where residents pay income taxes throughout the year. If too much tax has been withheld from your paycheck, you’re entitled to a refund. Think of it as the state saying, “Oops, my bad,” and handing back what’s rightfully yours.

But why does it matter? Well, for starters, refunds can provide a financial cushion. Maybe you’ve got bills piling up, or perhaps you’re planning that dream vacation. Whatever the case, an Oregon tax refund can give you that extra breathing room. Plus, who doesn’t love a little surprise in their bank account, right?

Additionally, understanding the refund process empowers you to make informed decisions about your finances. It’s all about taking control of your money and ensuring you’re not overpaying. So, whether you’re a seasoned tax pro or a newbie, knowing your refund rights is crucial.

How to Qualify for Oregon Tax Refund

Not everyone qualifies for an Oregon tax refund, but don’t worry, the rules are pretty straightforward. First off, you need to have paid income tax during the year. This means that if you’re self-employed, work for a company, or receive any form of taxable income, you’re likely eligible. The key here is that your withholding must exceed your actual tax liability.

Here’s a quick rundown of who typically qualifies:

- Residents of Oregon who file state taxes

- Non-residents who earn income in Oregon

- Part-year residents who worked in the state

It’s important to note that even if you’re not a full-time resident, you might still qualify for a refund if you’ve had taxes withheld on Oregon-based income. So, don’t assume you’re out of luck just because you didn’t live in the state all year.

Read also:Amanda Leariel Overstreet The Rising Star You Need To Know

Key Factors in Determining Eligibility

Several factors come into play when determining if you’re eligible for an Oregon tax refund:

- Income Level: Your income determines how much tax you owe, so if you’ve overpaid, you’re likely due a refund.

- Withholding Amount: The amount of tax withheld from your paycheck plays a big role. Too much withholding equals a potential refund.

- Dependents and Credits: Claiming dependents or utilizing tax credits can also impact your refund amount.

Remember, the more accurate your tax filing, the better your chances of getting the refund you deserve. It’s all about the details!

Understanding the Oregon Tax System

Oregon’s tax system is relatively straightforward compared to some other states, but it still has its quirks. The state operates on a progressive tax system, meaning the more you earn, the higher the tax rate. Currently, Oregon has three tax brackets: 5%, 7%, and 9%. But here’s the kicker—there’s no sales tax in Oregon, which is a win for shoppers!

When it comes to refunds, the process starts with filing your annual tax return. This is where you report your income, deductions, and credits. Once filed, the state reviews your return to determine if you’ve overpaid. If the numbers check out, voila! You’re in line for an Oregon tax refund.

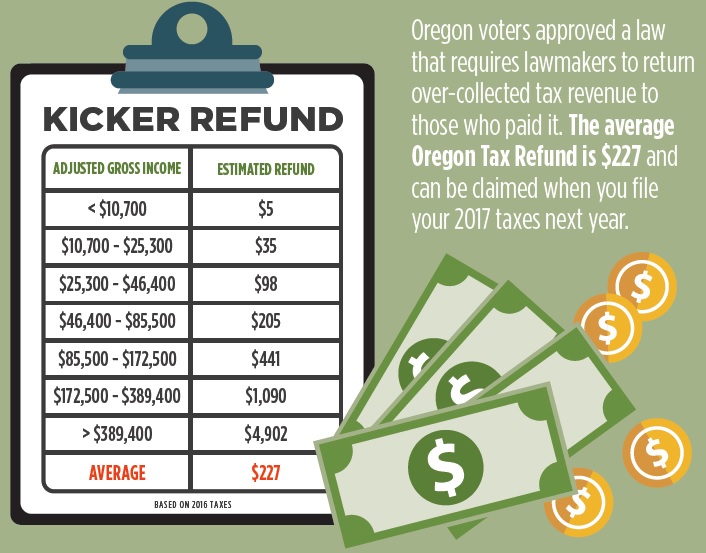

Another interesting aspect of Oregon’s tax system is the kicker law. This law mandates that if the state collects more revenue than projected, the excess must be returned to taxpayers. While this doesn’t directly relate to individual income tax refunds, it’s a unique feature that highlights Oregon’s commitment to fiscal responsibility.

Steps to File for Oregon Tax Refund

Filing for an Oregon tax refund might sound intimidating, but with the right steps, it’s a breeze. Here’s how you can do it:

Step 1: Gather Your Documents – Before you start, make sure you have all the necessary paperwork. This includes your W-2 forms, 1099s if applicable, and any other income-related documents.

Step 2: Complete Form OR-40 – This is Oregon’s official income tax return form. Fill it out accurately, claiming all applicable deductions and credits.

Step 3: Submit Your Return – You can file your return either by mail or electronically. E-filing is often faster and more convenient, plus it reduces the risk of errors.

Step 4: Wait for Your Refund – Once your return is processed, you’ll receive your refund via direct deposit or a check, depending on your preference.

Tips for a Smooth Filing Process

To ensure a seamless filing experience, consider these tips:

- Double-check all numbers to avoid mistakes.

- Use tax software or consult a professional if you’re unsure.

- File early to get your refund faster.

By following these steps, you’ll be well on your way to reclaiming your hard-earned cash. It’s all about being organized and proactive!

Common Mistakes to Avoid

While filing for an Oregon tax refund might seem straightforward, there are a few common mistakes people make that could cost them. First up, failing to report all sources of income. Whether it’s a side gig or investment income, every penny counts. Leaving out even a small amount can lead to discrepancies and delays in processing your refund.

Another big no-no is not claiming all available deductions and credits. Many people leave money on the table because they don’t take advantage of everything they’re entitled to. For example, Oregon offers a variety of credits, including those for education expenses and energy-efficient home improvements. Make sure you’re not missing out!

Lastly, incorrect personal information can wreak havoc on your refund. Double-check your Social Security number, address, and bank account details if you’re opting for direct deposit. A simple typo can delay your refund or even send it to the wrong place.

How Long Does It Take to Get Your Oregon Tax Refund?

Patience is a virtue, especially when it comes to tax refunds. So, how long does it take to get your Oregon tax refund? Typically, if you file electronically and opt for direct deposit, you can expect your refund within three to four weeks. Mailed returns might take a bit longer, usually around six to eight weeks.

Factors that can affect the timing include the complexity of your return, any errors that need correction, and the current workload of the Oregon Department of Revenue. If you’re anxious about the status of your refund, you can check it online through the department’s website. Just be sure to have your Social Security number and the exact refund amount handy.

What to Do If Your Refund Is Delayed

If your Oregon tax refund is taking longer than expected, don’t panic. First, verify that all your information was entered correctly. If everything checks out, give it a little more time. If after eight weeks you still haven’t received your refund, it’s time to reach out to the Oregon Department of Revenue for assistance.

Remember, delays happen, but most are easily resolved with a bit of persistence. Keep your documentation organized and be prepared to provide details if you need to escalate the issue.

Maximizing Your Oregon Tax Refund

Now that you know how to get your Oregon tax refund, let’s talk about maximizing it. One of the best ways to boost your refund is by taking full advantage of deductions and credits. Oregon offers a variety of options, so do your research to ensure you’re not leaving money on the table.

For instance, if you’ve made energy-efficient upgrades to your home, you might qualify for a credit. Similarly, education expenses can often be deducted, providing additional savings. Plus, don’t forget about federal deductions that can also impact your state refund.

Another tip is to adjust your withholding throughout the year. If you consistently receive large refunds, it might mean you’re letting the government hold onto your money interest-free. Consider adjusting your W-4 to keep more cash in your pocket each paycheck.

Where to Get Help With Oregon Tax Refund

If all this talk of forms and deductions has your head spinning, don’t worry—help is available. The Oregon Department of Revenue offers resources and assistance for taxpayers. Their website is a treasure trove of information, complete with FAQs, guides, and contact details.

For those who prefer face-to-face assistance, many local tax preparation services specialize in Oregon tax returns. These professionals can help ensure your return is accurate and maximized for the best possible refund. Plus, they can answer any questions you might have along the way.

Additionally, there are plenty of online tax software options that make filing a breeze. These programs walk you through the process step-by-step, ensuring you don’t miss any important details. Whether you choose to go it alone or seek professional help, the important thing is getting that refund!

Final Thoughts

So, there you have it—your ultimate guide to Oregon tax refund. From understanding eligibility to navigating the filing process, we’ve covered everything you need to know to get your money back. Remember, tax refunds aren’t just about getting cash; they’re about taking control of your finances and ensuring fairness in taxation.

Now it’s your turn to take action! Start gathering those documents, fill out your forms, and submit that return. And don’t forget to check back for updates and more tips on managing your money wisely. Got questions or comments? Drop them below—we’d love to hear from you!

Table of Contents

Article Recommendations