Montana Department Of Revenue: Your Ultimate Guide To Taxes, Licenses, And More

Let’s face it, folks—taxes and revenue departments can be a real head-scratcher. But don’t sweat it because today, we’re diving deep into the Montana Department of Revenue. Whether you’re a resident, a business owner, or just someone curious about how the state handles its finances, this article’s got you covered. We’ll break down everything you need to know about the Montana Department of Revenue in a way that’s easy to digest. So grab your coffee, sit tight, and let’s get started.

The Montana Department of Revenue, or MDR for short, plays a massive role in shaping the financial landscape of the state. From collecting taxes to issuing licenses, they’re the backbone of Montana’s revenue system. But what exactly do they do, and how does it impact you? That’s the million-dollar question we’re about to answer.

Now, if you’ve ever found yourself scratching your head over property taxes, vehicle registration, or business licenses, you’re not alone. The MDR handles all of that and more. In this guide, we’ll walk you through their services, responsibilities, and how you can navigate their systems like a pro. Let’s make sense of the chaos, shall we?

Read also:Kagney Lynn Carter The Rising Star In The Adult Entertainment Industry

What is the Montana Department of Revenue?

First things first—what exactly is the Montana Department of Revenue? Think of it as the state’s financial watchdog. The MDR is responsible for administering tax laws, collecting revenue, and ensuring that everything runs smoothly. They’re the folks who make sure everyone pays their fair share and that the state has the funds it needs to keep things running.

Here’s the deal: the MDR oversees a wide range of programs, including income tax, property tax, fuel tax, and more. They’re also in charge of issuing licenses for businesses, vehicles, and other activities. In short, they’re the ones keeping the financial wheels turning in Montana.

Key Responsibilities of the MDR

Let’s break down the main responsibilities of the Montana Department of Revenue:

- Administering state tax laws

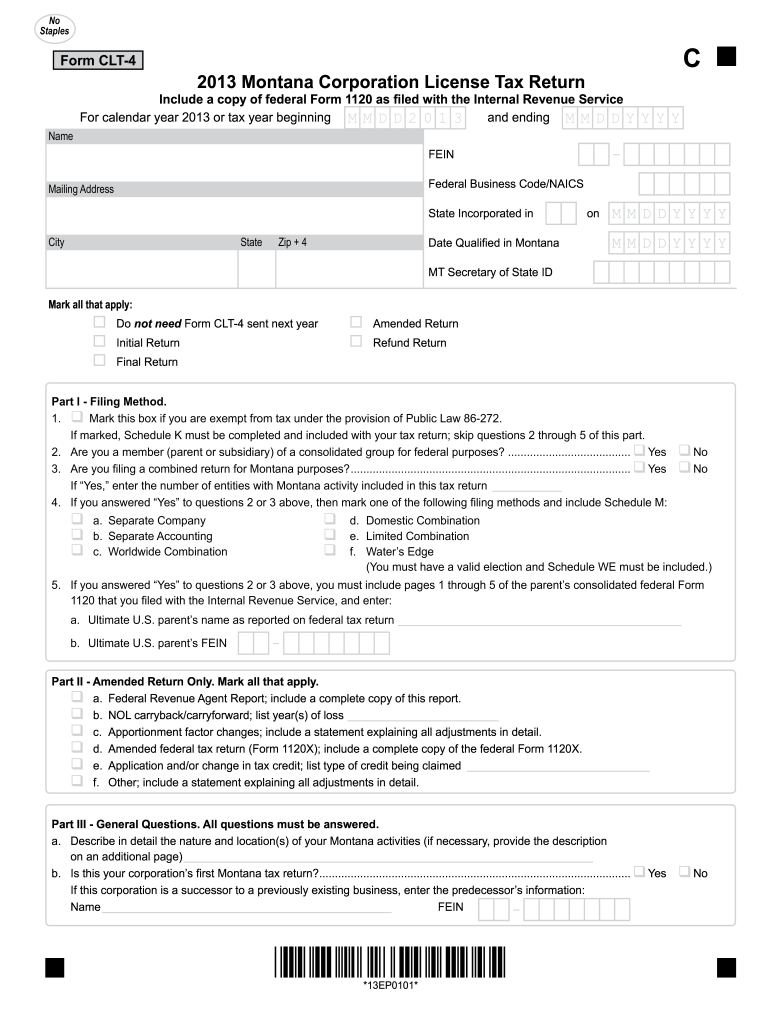

- Collecting individual and corporate income taxes

- Managing property tax assessments

- Issuing licenses and permits

- Enforcing tax compliance

- Providing resources and support to taxpayers

These responsibilities might sound straightforward, but trust me—they’re a big deal. Without the MDR, the state’s finances would be a chaotic mess. So, yeah, they’re kind of a big deal.

Montana Department of Revenue: A Brief History

Now, let’s take a quick trip down memory lane. The Montana Department of Revenue has been around for quite some time, evolving to meet the changing needs of the state. Established to manage the state’s revenue systems, the MDR has grown into a powerhouse of financial administration.

Over the years, they’ve introduced new programs, streamlined processes, and embraced technology to make things easier for residents and businesses. From online filing systems to digital license renewals, the MDR has stayed ahead of the curve. It’s pretty impressive if you ask me.

Read also:Indian Pueblo Cultural Center A Gateway To Native American Heritage

How Has the MDR Evolved?

Here’s a quick look at how the Montana Department of Revenue has evolved over the years:

- Introduction of electronic filing systems

- Expansion of online services

- Enhanced taxpayer support programs

- Adoption of modern data management tools

These advancements have made it easier than ever for people to interact with the MDR. No more long lines or piles of paperwork—everything’s just a few clicks away.

Understanding Montana’s Tax System

Taxes are one of the most important aspects of the Montana Department of Revenue’s work. But let’s face it—taxes can be confusing. So, let’s break it down and make it simple.

Montana’s tax system is designed to be fair and efficient. The state collects various types of taxes, including:

- Individual income tax

- Corporate income tax

- Property tax

- Excise tax

- Sales tax (on certain items)

Each of these taxes plays a crucial role in funding state programs and services. And guess what? The MDR is the one making sure everything’s in order.

How Does the MDR Collect Taxes?

The MDR uses a combination of methods to collect taxes, including:

- Electronic filing systems

- Paper filings

- Third-party reporting

- Enforcement actions

These methods ensure that everyone pays their fair share while minimizing errors and delays. It’s a pretty slick operation if you ask me.

Property Tax in Montana

Property tax is a big deal in Montana, and the MDR plays a key role in managing it. Property taxes are used to fund local governments, schools, and other essential services. But how exactly does it work?

Property tax rates in Montana vary depending on location and property type. The MDR works closely with local governments to assess property values and determine tax amounts. It’s a complex process, but one that ensures fair and accurate assessments.

How Are Property Taxes Assessed?

Here’s how the MDR assesses property taxes:

- Conducting property value assessments

- Using market data to determine fair values

- Collaborating with local governments

- Providing appeal options for property owners

These steps help ensure that property taxes are fair and transparent. If you’re a homeowner or landlord, it’s important to understand how this process works so you can make informed decisions.

Vehicle Registration and Licensing

Another key responsibility of the Montana Department of Revenue is vehicle registration and licensing. Whether you’re buying a new car or renewing your license, the MDR is involved.

Here’s the scoop: the MDR handles everything from vehicle titles to driver’s licenses. They work with local county offices to process applications, issue documents, and ensure compliance with state laws. It’s a pretty seamless process, thanks to their efficient systems.

What You Need to Know About Vehicle Registration

Here’s what you need to know about vehicle registration in Montana:

- Register your vehicle within 30 days of purchase

- Pay the appropriate registration fees

- Provide proof of insurance

- Renew your registration annually

These steps might seem simple, but they’re crucial for staying legal on the road. The MDR makes it easy to handle all your vehicle-related needs.

Business Licenses and Permits

If you’re a business owner in Montana, you’ll need to interact with the MDR at some point. The department is responsible for issuing licenses and permits to businesses across the state. But what exactly does this involve?

Well, the MDR ensures that businesses comply with state regulations and pay the appropriate taxes. They also provide resources and support to help businesses thrive. It’s a win-win situation for everyone involved.

How to Obtain a Business License in Montana

Here’s a step-by-step guide to obtaining a business license in Montana:

- Register your business with the MDR

- Apply for the appropriate licenses and permits

- Pay any required fees

- Stay up-to-date with tax obligations

These steps might seem straightforward, but they’re essential for running a successful business. The MDR is there to help you every step of the way.

Montana Department of Revenue Online Services

In today’s digital age, the MDR has embraced technology to make life easier for residents and businesses. Their online services are a game-changer, offering convenience and efficiency.

From filing taxes to renewing licenses, the MDR’s online portal has got you covered. You can access a wide range of services 24/7, saving you time and hassle. It’s like having the MDR at your fingertips.

What Services Are Available Online?

Here’s a list of services available through the MDR’s online portal:

- Tax filing and payment

- License renewal

- Property tax assessments

- Vehicle registration

- Business registration

These services are designed to make your life easier, so why not take advantage of them? The MDR’s online platform is user-friendly and secure, ensuring a smooth experience for everyone.

How to Contact the Montana Department of Revenue

Whether you have questions about taxes, licenses, or anything else, the MDR is here to help. They offer multiple ways to get in touch, making it easy to get the answers you need.

Here’s how you can contact the MDR:

- Visit their website for online support

- Call their customer service hotline

- Visit a local office in person

- Send an email or mail inquiry

These options ensure that you can reach out whenever and however you prefer. The MDR is committed to providing excellent customer service, so don’t hesitate to reach out if you need help.

Conclusion: Your Go-To Guide for the Montana Department of Revenue

And there you have it—a comprehensive guide to the Montana Department of Revenue. From taxes to licenses, the MDR plays a vital role in shaping the state’s financial landscape. Whether you’re a resident, a business owner, or just someone curious about how it all works, this guide has got you covered.

Remember, the MDR is here to help you navigate the often-confusing world of taxes and revenue. So don’t be afraid to reach out if you have questions or need assistance. And hey, while you’re at it, why not share this article with your friends and family? Knowledge is power, after all.

Thanks for reading, folks! If you found this article helpful, be sure to check out our other content for more insights and tips. Until next time, stay informed and keep those wallets open—Montana’s got big plans for the future!

Table of Contents

- What is the Montana Department of Revenue?

- Montana Department of Revenue: A Brief History

- Understanding Montana’s Tax System

- Property Tax in Montana

- Vehicle Registration and Licensing

- Business Licenses and Permits

- Montana Department of Revenue Online Services

- How to Contact the Montana Department of Revenue

- Conclusion

Article Recommendations