How Much Does Coinstar Charge? Unveiling The Fees And Services You Need To Know

Have you ever wondered how much Coinstar charges for converting your loose change into cold, hard cash? Well, buckle up because we're diving deep into the world of Coinstar fees, services, and everything in between. Whether you're a coin hoarder or just trying to figure out if Coinstar is worth it, this article has got you covered. Let's break it down step by step so you can make an informed decision.

Let's face it—most of us have jars, piggy banks, or even drawers filled with loose change that we've been meaning to cash out for ages. Coinstar offers a convenient way to turn those coins into usable cash or gift cards. But here's the million-dollar question: how much does Coinstar charge for their services? It's not just about convenience; it's about knowing what you're paying for.

We'll explore the ins and outs of Coinstar's fee structure, the benefits of using their service, and some alternatives you might want to consider. By the end of this article, you'll have all the info you need to decide whether Coinstar is the right choice for you. So, let's get started!

Read also:How Tall Is Sylvester Stallone Unveiling The Real Height Of The Action Legend

Table of Contents

- Introduction to Coinstar Fees

- Standard Coinstar Fee

- Redeem Options and Fees

- No-Fee Options

- How Coinstar Works

- Coinstar vs. Other Services

- Tips for Using Coinstar

- A Brief History of Coinstar

- Coinstar Usage Data

- Conclusion

Introduction to Coinstar Fees

Coinstar is more than just a machine for counting coins; it's a service designed to simplify the process of converting loose change into something more useful. But with great convenience comes a cost. Understanding how much Coinstar charges is essential if you're planning to use their services regularly.

For many people, Coinstar is the go-to solution when they need to turn piles of coins into cash quickly. However, the fees can add up, especially if you're dealing with large amounts of change. Let's take a closer look at the fee structure to see if it aligns with your financial goals.

Why Coinstar?

Before we dive into the numbers, let's talk about why Coinstar is so popular. For starters, it's super convenient. You don't have to sort, count, or roll your coins manually. Simply dump them into the machine, and Coinstar does all the work for you. Plus, they offer multiple redemption options, including cash, gift cards, and charitable donations.

Standard Coinstar Fee

Alright, here's the part you've been waiting for: the standard Coinstar fee. As of 2023, Coinstar charges a flat rate of 10.9% for converting coins into cash. This means that for every $100 worth of coins you insert, you'll receive $89.10 in cash. Not bad, right? But let's not stop there.

Key Points:

- Standard fee: 10.9%

- Minimum transaction amount: $10

- Fees apply only to cash redemption

Breaking Down the Fee

The 10.9% fee covers the cost of processing your coins, maintaining the machines, and providing a hassle-free experience. While it might seem steep at first glance, it's important to weigh the convenience factor against the fee. For most people, the time saved by not having to count and roll coins manually is well worth the cost.

Read also:Randall Tex Cobb The Man Behind The Mask In Hollywoods Most Iconic Roles

Redeem Options and Fees

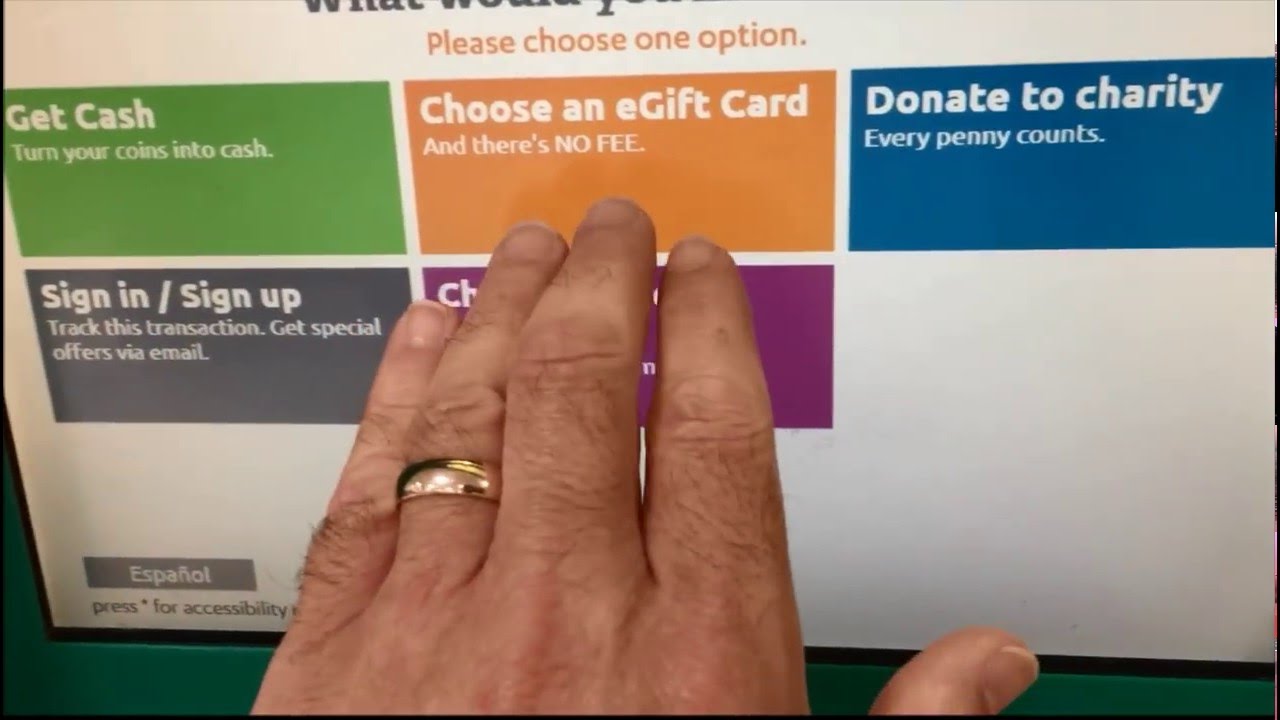

One of the coolest things about Coinstar is the variety of redemption options they offer. Sure, you can opt for cash, but there are other ways to redeem your coins that might save you money—or even earn you rewards. Let's explore some of these options:

- Cash Redemption: As mentioned earlier, this comes with a 10.9% fee.

- Gift Cards: Redeem your coins for gift cards with no additional fees. Some popular options include Amazon, Starbucks, and Walmart.

- Charitable Donations: Donate your coins to a charity of your choice with no fees whatsoever. It's a win-win situation!

Which Option is Best for You?

The answer depends on your needs. If you're looking to pocket the most cash, the gift card option might be the way to go. On the other hand, if you're feeling generous, donating your coins to charity is a great way to give back to the community.

No-Fee Options

Surprise! There are actually ways to use Coinstar without paying any fees at all. Here's how:

- Charitable Donations: As mentioned earlier, donating your coins to charity is completely free.

- Partner Bank Accounts: If you have an account with one of Coinstar's partner banks, such as Bank of America or Wells Fargo, you can deposit your coins directly into your account with no fees. It's like having a personal coin-counting service for free!

Why Partner with Banks?

Coinstar's partnerships with major banks make it easier for customers to deposit coins without worrying about fees. It's a smart move that benefits both parties: Coinstar gets more users, and banks get more deposits. Win-win!

How Coinstar Works

Now that we've covered the fees and redemption options, let's take a look at how Coinstar actually works. The process is simple and straightforward:

- Find a Coinstar machine near you. They're usually located in grocery stores, pharmacies, and other retail locations.

- Insert your coins into the machine. No need to sort or count them beforehand!

- Choose your redemption option: cash, gift card, or charity.

- Collect your cash or gift card, or confirm your donation.

What Happens to the Coins?

Once you've inserted your coins into the machine, they're sorted, counted, and sent to a processing facility. From there, they're sent to banks and financial institutions to be reintroduced into circulation. It's a pretty efficient system, and it helps keep the economy running smoothly.

Coinstar vs. Other Services

While Coinstar is a popular choice for converting coins into cash, it's not the only option out there. Let's compare Coinstar to some of its competitors:

- Bank Coin Counters: Many banks offer free coin-counting services for their customers. However, these machines often require you to roll your coins manually, which can be time-consuming.

- Third-Party Services: Some companies offer coin-counting services for a lower fee than Coinstar. However, they may not be as convenient or widely available.

- DIY Methods: If you're feeling adventurous, you can always count and roll your coins yourself. This option is completely free, but it requires a lot of time and effort.

Which Option is Right for You?

It all depends on your priorities. If convenience is key, Coinstar is a great choice. If you're looking to save money, consider using your bank's coin-counting service or rolling your coins yourself.

Tips for Using Coinstar

Now that you know how Coinstar works and what to expect in terms of fees, here are a few tips to help you make the most of the service:

- Maximize Gift Card Redemption: If you frequently shop at places like Amazon or Starbucks, consider redeeming your coins for gift cards instead of cash. You'll save on fees and still get the products you love.

- Check for Promotions: Coinstar occasionally offers promotions that reduce or eliminate fees for certain redemption options. Keep an eye out for these deals to save even more money.

- Use Partner Banks: If you have an account with a Coinstar partner bank, take advantage of the no-fee deposit option. It's a great way to turn your coins into savings without losing any money to fees.

A Brief History of Coinstar

Coinstar was founded in 1991 by two University of Washington students, Jeff Cash and Dave Harrington. Their goal was simple: create a machine that could count coins quickly and accurately. Over the years, Coinstar has grown into a global company with thousands of machines in operation. Today, they process billions of coins annually, making them one of the largest coin-counting services in the world.

Fun Fact:

In 2013, Coinstar rebranded itself as Outerwall, the parent company of Redbox and other automated retail services. However, the Coinstar name lives on as the company's flagship product.

Coinstar Usage Data

Here are some interesting stats about Coinstar's usage:

- Over 20 billion coins processed annually

- More than 20,000 Coinstar machines in operation worldwide

- Average transaction value: $30

- Most popular redemption option: gift cards

What Does This Mean for You?

These numbers show that Coinstar is a widely used and trusted service. With millions of customers relying on their machines every year, you can feel confident that your coins are in good hands.

Conclusion

So, how much does Coinstar charge? The standard fee is 10.9%, but there are plenty of ways to save money or even avoid fees altogether. Whether you're looking to turn your coins into cash, gift cards, or charitable donations, Coinstar offers a convenient and reliable solution. Just remember to weigh the convenience factor against the cost and explore alternative options if necessary.

Now it's your turn! Have you used Coinstar before? What was your experience like? Leave a comment below and let us know. And don't forget to share this article with your friends and family so they can learn more about Coinstar and its services.

Article Recommendations