Prime Net Worth 2024: The Ultimate Guide To Understanding Wealth In The Modern Era

Let’s talk about prime net worth in 2024, because let’s be real—money talks, and it’s a big deal. Whether you’re trying to figure out how to grow your wealth or just curious about what the richest folks are doing, understanding net worth is crucial. It’s not just about having a lot of cash; it’s about how you manage assets, liabilities, and investments. And in 2024, the game has changed—big time. So buckle up, because we’re diving deep into the world of prime net worth, where numbers tell stories and strategies shape destinies.

Now, before we get into the nitty-gritty, let’s set the stage. Net worth isn’t just some fancy term thrown around by financial experts; it’s a real measure of where you stand financially. Think of it as the scorecard for your life’s financial journey. And in 2024, with inflation, global economic shifts, and tech disruptions, knowing your net worth—and how to boost it—is more important than ever. This isn’t just about the rich getting richer; it’s about empowering YOU to take control of your financial future.

Here’s the deal: whether you’re a young professional, a seasoned entrepreneur, or someone who’s just starting to think about building wealth, this guide is here to help. We’ll break down the basics, explore trends, and even look at some of the wealthiest individuals on the planet. But don’t worry—we won’t just dump data on you. We’ll make sure everything is easy to digest, actionable, and, most importantly, relatable. Let’s do this!

Read also:Raab Himself Net Worth The Untold Story Of Success Fame And Fortune

Table of Contents:

- What is Net Worth?

- Prime Net Worth in 2024

- Calculating Your Net Worth

- The Wealthiest People in 2024

- Global Net Worth Trends

- Building Your Prime Net Worth

- Investments and Assets

- Financial Strategies for Growth

- Common Mistakes to Avoid

- The Future of Wealth in 2024 and Beyond

What is Net Worth?

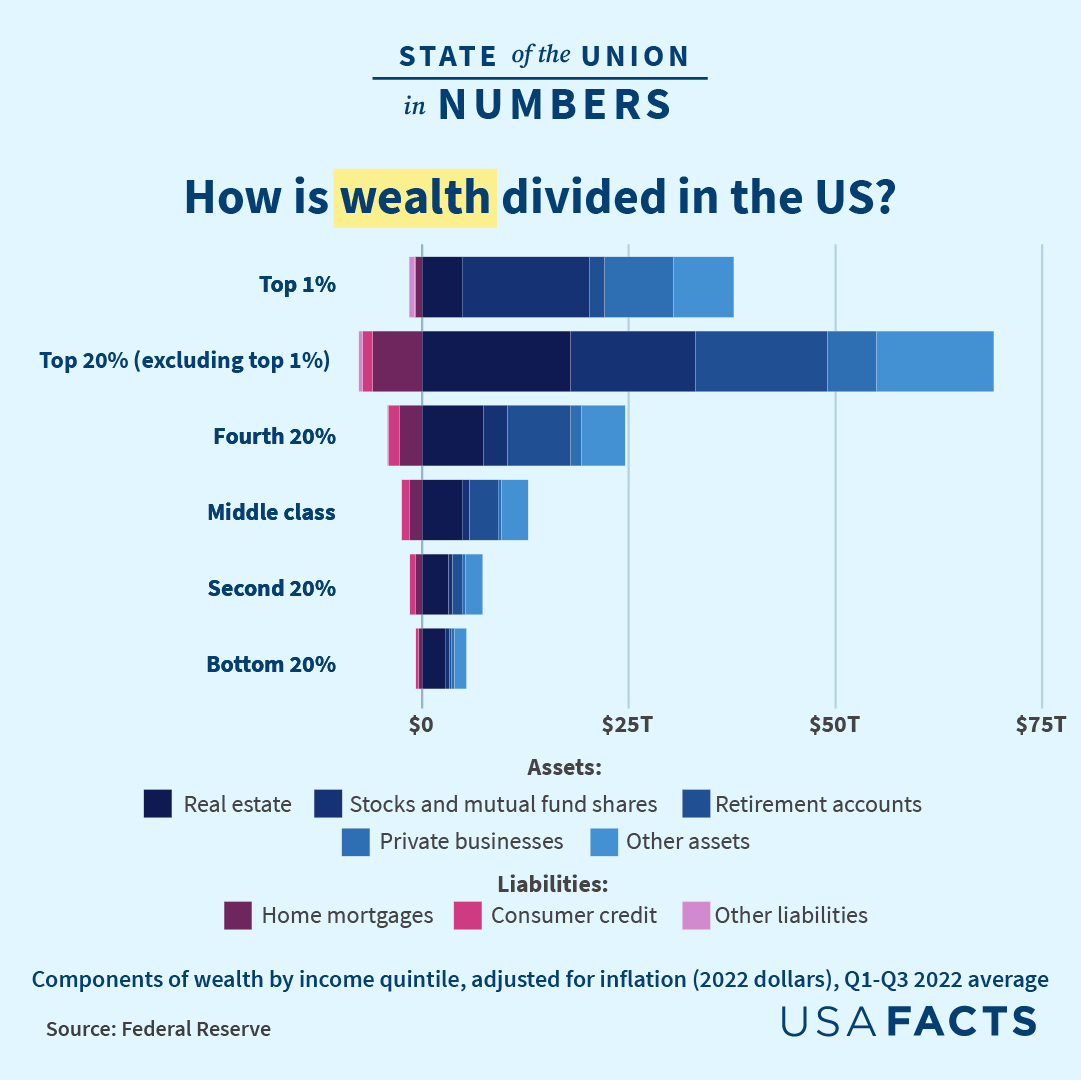

Alright, let’s start with the basics. Your net worth is essentially the difference between what you own (assets) and what you owe (liabilities). It’s like taking a snapshot of your financial health at any given moment. Assets can include things like your house, car, savings, investments, and even that vintage guitar collecting dust in your attic. Liabilities, on the other hand, are your debts—think mortgages, student loans, credit card balances, and anything else you owe money on.

Here’s the formula, just to keep it simple:

Net Worth = Assets – Liabilities

Now, here’s the kicker: your net worth doesn’t have to be positive to be meaningful. Even if you’re in the red, understanding your net worth is the first step toward improving it. And trust me, in 2024, with all the financial tools and resources available, turning things around is more achievable than ever.

Prime Net Worth in 2024

Understanding the Term "Prime Net Worth"

So, what exactly does “prime net worth” mean? Think of it as the sweet spot—the point where your financial situation is optimized for growth and stability. It’s not just about having a high net worth; it’s about having the right mix of assets, manageable liabilities, and smart investments. In 2024, prime net worth is all about adaptability. With markets fluctuating and new opportunities emerging, staying flexible is key.

Read also:Inside The Life Of Justin Thomas Wife A Closer Look At Their Journey

Why Prime Net Worth Matters

Here’s the thing: prime net worth isn’t just for the ultra-wealthy. It’s for anyone who wants to take control of their finances. Whether you’re aiming to retire early, buy your dream home, or just feel more secure about your financial future, understanding prime net worth is the foundation. And in 2024, with so many economic uncertainties, having a solid grasp on your financial health can be a game-changer.

Calculating Your Net Worth

Now, let’s get practical. How do you calculate your net worth? It’s easier than you think. Grab a pen and paper—or, better yet, open up a spreadsheet—and start listing out your assets and liabilities. Here’s a quick breakdown:

- Assets: Cash, savings, investments, real estate, vehicles, valuable possessions.

- Liabilities: Mortgages, loans, credit card debt, any outstanding bills.

Once you’ve got everything listed, subtract your liabilities from your assets. Voila! That’s your net worth. Easy, right? But here’s the thing: don’t get discouraged if the number isn’t where you want it to be. The beauty of net worth is that it’s a snapshot, not a permanent state. With the right strategies, you can improve it over time.

The Wealthiest People in 2024

Who’s at the Top?

Let’s talk about the big players. In 2024, the wealthiest individuals on the planet are still dominating headlines. Names like Elon Musk, Jeff Bezos, and Bernard Arnault continue to top the charts. But what sets them apart? Sure, they’ve got billions in the bank, but it’s their strategies, vision, and ability to adapt that keep them at the top. Here’s a quick look at some of the richest people in the world and their prime net worth:

| Name | Net Worth (Approx.) | Primary Source of Wealth |

|---|---|---|

| Elon Musk | $250 billion | Tesla, SpaceX |

| Jay-Z | $1.4 billion | Music, Business Ventures |

| Kim Kardashian | $1 billion | Skims, Social Media |

Lessons from the Wealthiest

What can we learn from these financial titans? First, they’re not afraid to take risks. Second, they’re constantly innovating and adapting to changing markets. And third, they prioritize long-term growth over short-term gains. These lessons are applicable to anyone looking to build their prime net worth in 2024.

Global Net Worth Trends

Now, let’s zoom out and look at the bigger picture. Globally, net worth trends are shifting in 2024. With the rise of cryptocurrency, the growing importance of sustainability, and the impact of global events, the way we think about wealth is evolving. Here are a few key trends to watch:

- Crypto Surge: Bitcoin and other cryptocurrencies are gaining traction as legitimate investment options.

- Sustainable Investing: More people are prioritizing eco-friendly investments, from green energy to ethical companies.

- Remote Work Revolution: The shift to remote work is changing how people allocate their assets, with many investing in property outside traditional urban centers.

Building Your Prime Net Worth

Step-by-Step Guide

Ready to build your prime net worth? Here’s a step-by-step guide to get you started:

- Track Your Expenses: Know where your money is going and cut unnecessary costs.

- Pay Down Debt: Focus on reducing high-interest liabilities first.

- Invest Wisely: Explore stocks, bonds, real estate, and other opportunities.

- Save Regularly: Set aside a portion of your income each month for emergencies and future goals.

Tools and Resources

In 2024, there are tons of tools and resources to help you build your net worth. From budgeting apps like Mint and YNAB to investment platforms like Robinhood and Acorns, the options are endless. And don’t forget about financial advisors—they can provide personalized guidance to help you reach your goals.

Investments and Assets

Types of Investments

When it comes to building prime net worth, investments are key. Here are some of the most popular types:

- Stocks: Owning shares in companies can lead to significant returns, but comes with risk.

- Bonds: A safer option, offering fixed interest payments over time.

- Real Estate: Property can appreciate in value and generate rental income.

- Cryptocurrency: High-risk, high-reward digital assets gaining popularity.

Maximizing Your Assets

Don’t let your assets sit idle. Whether it’s renting out unused space in your home or selling valuable items you no longer need, there are plenty of ways to maximize their value. And remember, diversification is key—spreading your investments across different asset classes can help mitigate risk.

Financial Strategies for Growth

Now, let’s talk strategy. Building prime net worth isn’t just about saving and investing; it’s about having a plan. Here are a few strategies to consider:

- Automate Savings: Set up automatic transfers to your savings or investment accounts.

- Reinvest Dividends: Use earnings from investments to buy more shares or assets.

- Stay Informed: Keep up with market trends and economic news to make informed decisions.

Common Mistakes to Avoid

Of course, no discussion of prime net worth would be complete without addressing common mistakes. Here are a few pitfalls to watch out for:

- Ignoring Debt: Letting liabilities pile up can derail your financial progress.

- Overextending: Taking on too much risk or spreading yourself too thin can backfire.

- Not Planning for the Future: Failing to set long-term goals can lead to stagnation.

The Future of Wealth in 2024 and Beyond

So, where is wealth heading in 2024 and beyond? The future looks bright for those who are proactive and adaptable. With advancements in technology, changes in consumer behavior, and new financial opportunities emerging every day, the possibilities are endless. The key is to stay informed, think long-term, and be willing to pivot when necessary.

Final Thoughts

In conclusion, prime net worth in 2024 is all about taking control of your financial future. Whether you’re just starting out or looking to refine your strategies, understanding net worth is the foundation for success. By calculating your net worth, exploring investment opportunities, and avoiding common mistakes, you can set yourself up for long-term prosperity.

So, what are you waiting for? Take action today! Leave a comment below, share this article with your friends, and start building your prime net worth. The future is yours for the taking—go get it!

Article Recommendations