Unveiling The Oregon Dept Of Revenue: Your Ultimate Guide

Hey there, tax-savvy friends! If you're diving into the world of taxes in the great state of Oregon, you're definitely in the right place. The Oregon Dept of Revenue is more than just a government office; it's the hub where all things tax-related come alive. Whether you're a resident trying to file your annual returns or a business owner navigating the complexities of state taxes, this department plays a pivotal role. So, buckle up, because we're about to break it down in a way that'll make your tax journey smoother than ever.

Let's face it, taxes can be a headache. But with the right information, you can turn that headache into a smooth process. The Oregon Dept of Revenue is here to help you every step of the way, from understanding tax laws to ensuring you're compliant with state regulations. In this guide, we'll explore everything you need to know about this department, from its history to the services it offers.

As we journey through the ins and outs of the Oregon Dept of Revenue, you'll gain insights that'll not only help you with your taxes but also empower you to make informed financial decisions. So, whether you're a newbie to the world of taxes or a seasoned pro, there's something in here for everyone. Let's dive right in!

Read also:Funny Work Memes The Ultimate Guide To Boosting Your Workplace Morale

Understanding the Oregon Dept of Revenue

First things first, what exactly is the Oregon Dept of Revenue? Well, it's the state agency responsible for administering Oregon's tax laws. This means they handle everything from income taxes to excise taxes, and even property taxes. They're the go-to place for all your tax-related queries and needs.

The department's mission is to ensure that all Oregonians pay their fair share of taxes, while also providing resources and support to make the process as painless as possible. They strive to be transparent, efficient, and customer-focused, which is a big deal in the world of government agencies.

History and Evolution

The Oregon Dept of Revenue has a rich history that dates back to the early days of statehood. Over the years, it has evolved to meet the changing needs of the state's economy and population. From manual processes to the digital age, the department has kept up with the times, ensuring that Oregonians have access to the latest tools and resources for tax compliance.

One of the key milestones in the department's history was the introduction of electronic filing, which revolutionized the way people filed their taxes. This move not only made the process faster and more efficient but also reduced errors, benefiting both taxpayers and the department.

Key Services Offered by the Oregon Dept of Revenue

Now that we've got the basics down, let's talk about the services that make the Oregon Dept of Revenue so essential. Here are some of the key services they offer:

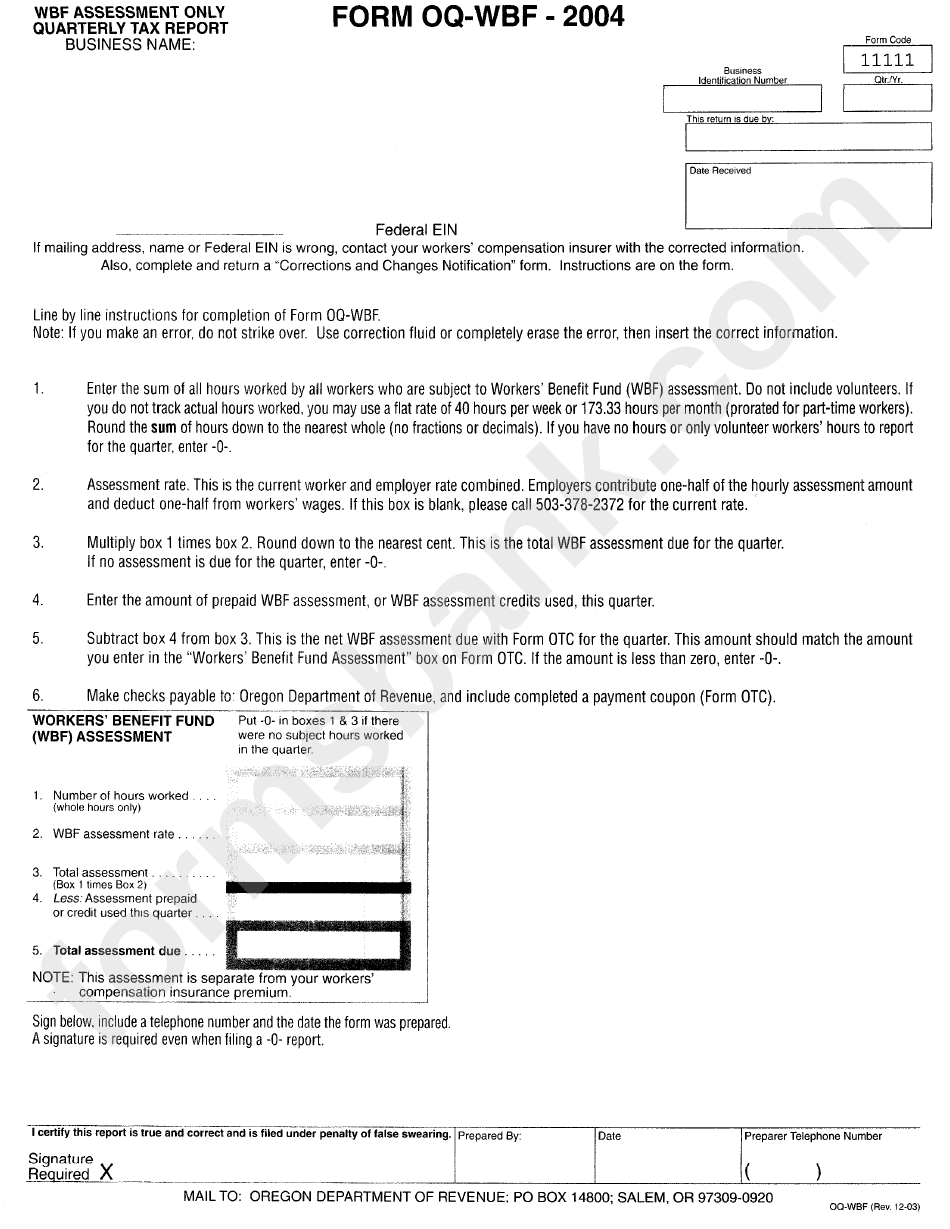

- Income Tax Filing: Whether you're an individual or a business, the department provides all the resources you need to file your income taxes accurately and on time.

- Business Tax Assistance: From sales tax to corporate taxes, they've got you covered. The department offers guidance and support to help businesses stay compliant with state tax laws.

- Property Tax Assistance: Understanding property taxes can be tricky, but the Oregon Dept of Revenue is here to help you navigate the process.

- Excise and Special Taxes: This includes taxes on items like fuel, alcohol, and tobacco. The department ensures these taxes are collected appropriately.

How to File Your Taxes with the Oregon Dept of Revenue

Filing your taxes doesn't have to be a daunting task. The Oregon Dept of Revenue provides several methods to make the process as easy as possible. You can file electronically, which is the most efficient method, or you can opt for traditional mail-in filing if that's your preference.

Read also:Galilea La Salvia The Hidden Gem You Need To Discover Now

For electronic filing, you'll need to use a certified software provider or an authorized e-file provider. This method not only speeds up the process but also allows you to receive your refund faster if you're due one. And don't worry, the department offers plenty of resources to guide you through the process.

Understanding Oregon's Tax Laws

Let's take a moment to delve into Oregon's tax laws. It's important to understand these laws because they directly impact how much tax you owe and how you file your returns. Oregon has a unique tax structure compared to other states, so it's worth taking the time to get familiar with it.

One notable aspect of Oregon's tax laws is the lack of a state sales tax. This sets Oregon apart from many other states and can be a significant benefit for residents and visitors alike. However, Oregon does have a robust income tax system, which is where the Oregon Dept of Revenue comes into play.

Common Tax Mistakes to Avoid

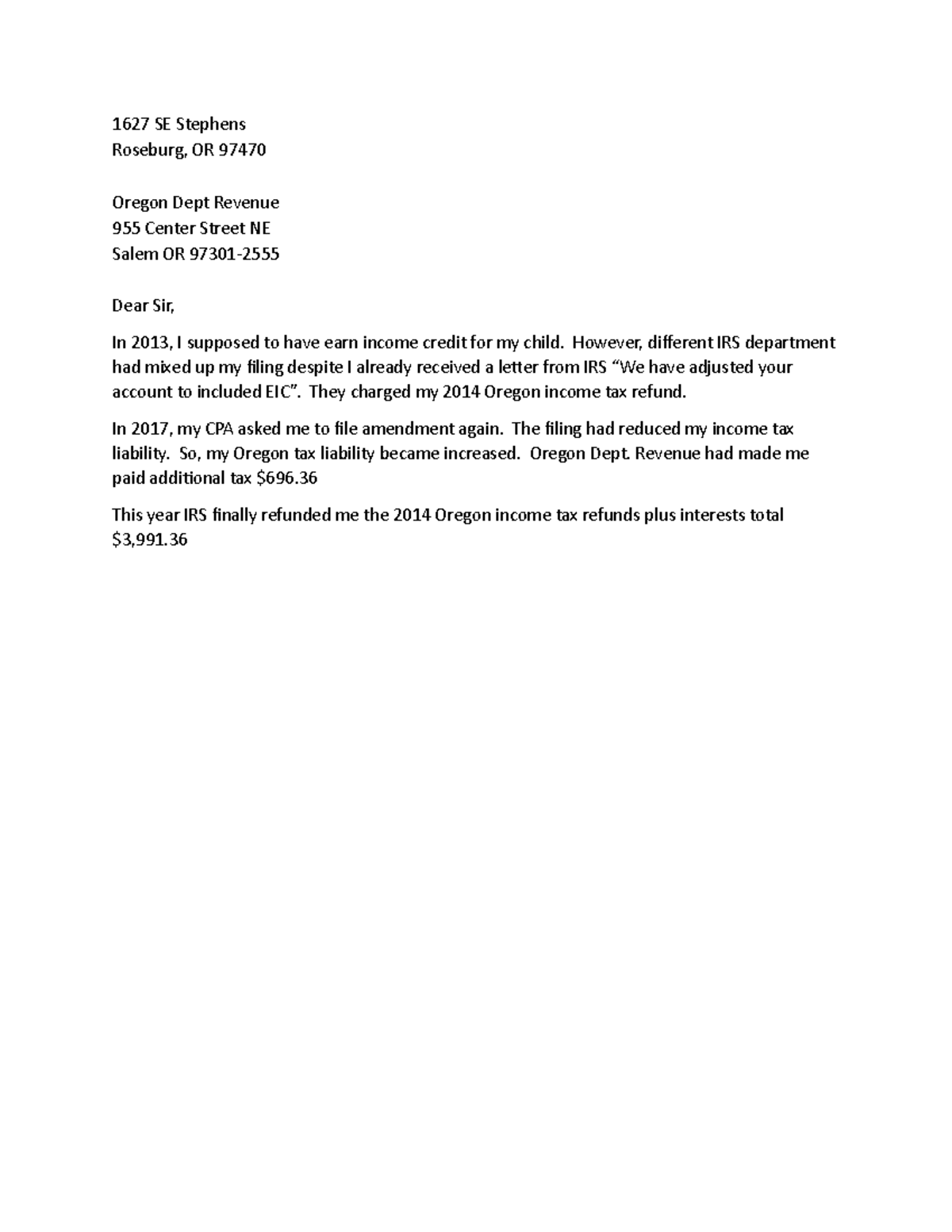

Even the most diligent taxpayers can make mistakes when filing their taxes. Here are a few common errors to watch out for:

- Missing Deadlines: Always keep track of important tax deadlines to avoid penalties.

- Incorrect Information: Double-check all the information you provide to ensure accuracy.

- Not Claiming All Deductions: Make sure you're taking advantage of all the deductions you're eligible for.

By being aware of these common pitfalls, you can save yourself a lot of hassle and potentially a lot of money.

Resources and Tools from the Oregon Dept of Revenue

The Oregon Dept of Revenue offers a wealth of resources and tools to help taxpayers navigate the often complex world of taxes. Whether you're looking for forms, guides, or online tools, the department has you covered.

One of the most useful resources is their online portal, which allows taxpayers to manage their accounts, view tax information, and even make payments. This portal is a game-changer for anyone looking to streamline their tax management process.

Customer Support and Assistance

Need help? The Oregon Dept of Revenue offers excellent customer support to assist taxpayers with any questions or issues they may have. You can reach them via phone, email, or even in person at one of their many offices across the state.

They also host workshops and seminars throughout the year, providing valuable insights and tips on tax-related topics. These events are a great way to stay informed and up-to-date with the latest changes in tax laws and regulations.

Tips for Navigating the Oregon Dept of Revenue

Here are some tips to help you make the most out of your interactions with the Oregon Dept of Revenue:

- Stay Organized: Keep all your tax-related documents in one place to make filing easier.

- Utilize Online Resources: Take advantage of the department's online tools and resources to simplify your tax process.

- Seek Professional Help if Needed: If you're unsure about anything, don't hesitate to consult a tax professional or reach out to the department for assistance.

Staying Informed

Tax laws and regulations are constantly evolving, so it's crucial to stay informed. The Oregon Dept of Revenue regularly updates their website with the latest news and information, so be sure to check in often. You can also sign up for their newsletters to get updates delivered straight to your inbox.

The Future of the Oregon Dept of Revenue

As we look to the future, the Oregon Dept of Revenue continues to innovate and improve its services. With advancements in technology and changes in tax laws, the department is committed to staying ahead of the curve to better serve the people of Oregon.

One of the exciting developments on the horizon is the expansion of digital services. The department is working on enhancing their online portal to provide even more features and functionalities, making it easier than ever for taxpayers to manage their accounts.

Conclusion and Call to Action

And there you have it, a comprehensive look at the Oregon Dept of Revenue. From understanding tax laws to utilizing the department's resources, you're now equipped with the knowledge to tackle your tax responsibilities with confidence.

So, what's next? We encourage you to take action by exploring the resources available on the Oregon Dept of Revenue's website. If you have any questions or need further assistance, don't hesitate to reach out to them. And remember, staying informed is key to staying compliant and making the most of your financial situation.

Lastly, if you found this guide helpful, please share it with others who might benefit from it. Together, let's make tax season a little less stressful for everyone. Thanks for reading, and happy filing!

Table of Contents

- Unveiling the Oregon Dept of Revenue: Your Ultimate Guide

- Understanding the Oregon Dept of Revenue

- History and Evolution

- Key Services Offered by the Oregon Dept of Revenue

- How to File Your Taxes with the Oregon Dept of Revenue

- Understanding Oregon's Tax Laws

- Common Tax Mistakes to Avoid

- Resources and Tools from the Oregon Dept of Revenue

- Customer Support and Assistance

- Tips for Navigating the Oregon Dept of Revenue

- Staying Informed

- The Future of the Oregon Dept of Revenue

- Conclusion and Call to Action

Article Recommendations