Rent 2 Own: The Smart Way To Own Your Dream Home

Let’s be real here, folks. Rent 2 Own is more than just a buzzword in the real estate game—it’s a game-changer for anyone who’s been dreaming of owning their own space but hasn’t quite figured out how to make it happen yet. If you’ve been stuck between renting forever and taking the plunge into homeownership, Rent 2 Own might just be the golden ticket you’ve been waiting for. But hey, before we dive deep, let’s get one thing straight—this isn’t your average real estate scheme. It’s legit, it’s smart, and it’s here to help you build equity while you live in the house you could one day call your own.

Now, I know what you’re thinking. “Rent 2 Own sounds too good to be true.” Trust me, I’ve been there too. But here’s the deal: when done right, Rent 2 Own can be an incredible opportunity for people who want to own a home but might not qualify for a traditional mortgage right now. Whether it’s due to credit score issues, saving up for a down payment, or simply needing more time to figure things out, Rent 2 Own gives you that breathing room without locking you into something you’re not ready for.

So, buckle up because we’re about to break down everything you need to know about Rent 2 Own. From how it works to the pros and cons, we’re covering it all. By the end of this, you’ll know exactly whether Rent 2 Own is right for you—and if it is, you’ll have all the info you need to get started. Let’s do this!

Read also:Chevy S10 For Sale Your Ultimate Guide To Finding The Right Truck

What Exactly is Rent 2 Own?

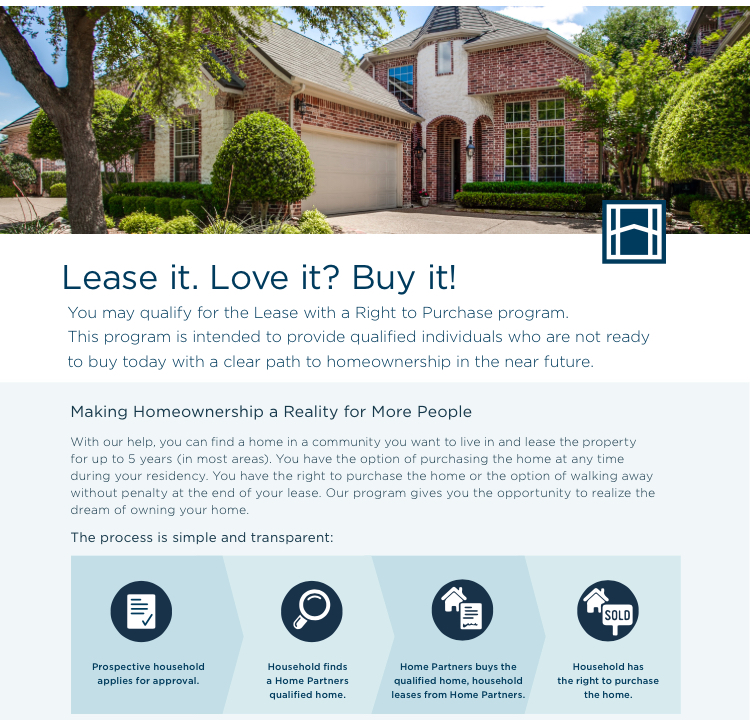

Alright, let’s start with the basics. Rent 2 Own, also known as lease-to-own or lease-option, is essentially a hybrid between renting and buying. Think of it like renting with the option to buy later. Here’s how it usually goes down: you sign a lease agreement with a landlord or seller, and part of your rent payment goes toward a future down payment if you decide to purchase the property at the end of the lease period.

This setup is perfect for people who aren’t quite ready to commit to a mortgage but still want to start building equity in a home. Plus, it gives you time to improve your credit score, save up more money, or just get your financial house in order before making that big decision.

Why Should You Consider Rent 2 Own?

There are plenty of reasons why Rent 2 Own could be a great option for you. Here’s a quick rundown:

- No immediate mortgage commitment: You don’t have to jump into a mortgage right away, which means less pressure and more flexibility.

- Build equity while renting: A portion of your rent payments goes toward the future purchase price, so you’re not just throwing money away.

- Time to improve your credit: If your credit score isn’t where it needs to be, Rent 2 Own gives you the time to work on it without losing out on the property.

- Try before you buy: You get to live in the house for a while to see if it’s really the right fit for you before committing to a purchase.

How Does Rent 2 Own Work?

Here’s the nitty-gritty of how Rent 2 Own actually works. First, you’ll sign a lease agreement that includes an option to buy the property at the end of the lease term. The lease term can vary, but it’s typically between one and three years. During this time, you’ll pay rent as usual, but a portion of that rent will go toward the purchase price if you decide to buy.

In addition to the rent, there’s usually an option fee, which is a non-refundable fee that gives you the right (but not the obligation) to buy the property at the end of the lease term. The purchase price is usually agreed upon upfront, so you know exactly what you’re getting into.

Breaking Down the Process

Let’s break it down step by step:

Read also:The Things We Leave Unfinished A Journey Through Lifes Incomplete Chapters

- Find the right property: Look for properties that offer Rent 2 Own options. This might take some digging, but it’s worth it.

- Sign the lease-option agreement: This is where you lock in the terms, including the purchase price and how much of your rent will go toward the down payment.

- Pay the option fee: This is the fee that secures your option to buy. It’s usually a percentage of the purchase price.

- Live in the house: For the duration of the lease term, you’ll live in the house and make rent payments.

- Decide to buy or not: At the end of the lease term, you can choose to buy the property or walk away.

Who Benefits From Rent 2 Own?

Not everyone is a good candidate for Rent 2 Own, but it can be a fantastic option for certain people. Here are some examples:

- First-time homebuyers: If you’re new to the world of homeownership and need time to save up or improve your credit, Rent 2 Own can be a great stepping stone.

- People with credit issues: If your credit score isn’t where it needs to be for a traditional mortgage, Rent 2 Own gives you time to work on it.

- Those who want flexibility: If you’re not ready to commit to a mortgage but still want to start building equity, this could be the perfect solution.

Is Rent 2 Own Right for You?

Ask yourself these questions:

- Do I want to own a home but need more time to prepare financially?

- Am I comfortable with the idea of renting for a few years before buying?

- Do I trust the seller and believe they’ll honor the agreement?

The Pros and Cons of Rent 2 Own

Like anything in life, Rent 2 Own has its pros and cons. Let’s weigh them out:

Pros

- Build equity while renting.

- Get time to improve credit or save money.

- Try out the property before committing to a purchase.

Cons

- Option fee is non-refundable if you don’t buy.

- Rent payments may be higher than traditional rentals.

- Property may lose value over time, making the purchase less appealing.

How to Find Rent 2 Own Properties

Finding Rent 2 Own properties can be a bit tricky, but it’s definitely doable. Here are some tips:

- Check online listings: Websites like Zillow and Realtor.com often have Rent 2 Own listings.

- Work with a real estate agent: A good agent can help you find properties that fit your criteria.

- Network locally: Sometimes the best deals come from word of mouth, so don’t be afraid to ask around.

What to Look for in a Rent 2 Own Property

When you’re shopping for a Rent 2 Own property, keep these things in mind:

- Location: Is it in a neighborhood you want to live in?

- Condition: Is the property in good shape, or will you need to make repairs?

- Terms: Are the lease terms and purchase price fair and reasonable?

Understanding the Costs Involved

Rent 2 Own comes with its own set of costs, so it’s important to understand what you’re getting into. Here’s a breakdown:

- Rent payments: These will likely be higher than traditional rentals since part of the payment goes toward the purchase price.

- Option fee: This non-refundable fee secures your option to buy.

- Maintenance costs: Depending on the agreement, you may be responsible for maintenance and repairs.

How Much Should You Budget?

It’s hard to give an exact number since costs can vary widely depending on the property and location. However, you should expect to pay more than you would for a traditional rental. Make sure you have a solid budget in place before signing any agreements.

Legal Considerations and Protecting Yourself

When it comes to Rent 2 Own, protecting yourself legally is crucial. Here are some things to keep in mind:

- Get everything in writing: Make sure the lease-option agreement clearly outlines all terms and conditions.

- Work with a lawyer: Having a legal expert review the agreement can save you a lot of headaches down the road.

- Understand your rights: Know what you’re entitled to and what obligations you have under the agreement.

Common Pitfalls to Avoid

Here are some common mistakes to watch out for:

- Not reading the fine print.

- Trusting the seller without doing your own due diligence.

- Not having a solid plan for improving your financial situation during the lease term.

Final Thoughts: Is Rent 2 Own Worth It?

At the end of the day, Rent 2 Own can be an excellent option for the right person. It offers flexibility, the chance to build equity, and the opportunity to try out a property before committing to a purchase. However, it’s not without its risks, so it’s important to do your homework and make sure it’s the right choice for you.

So, what’s next? If you’re seriously considering Rent 2 Own, start by researching properties in your area and talking to real estate professionals. And remember, don’t rush into anything—take your time to make sure it’s the right move for you.

Oh, and one last thing—don’t forget to leave a comment below if you have any questions or thoughts about Rent 2 Own. Sharing is caring, folks!

Table of Contents

Article Recommendations