Ardent Credit Union: Your Trusted Financial Partner For A Secure Future

When it comes to managing your finances, finding the right financial institution can be overwhelming. Ardent Credit Union stands out as a reliable and member-focused organization that prioritizes your needs. With a commitment to service and community, Ardent Credit Union offers more than just banking—it offers peace of mind and personalized solutions tailored to your financial journey.

Ardent Credit Union isn’t just another financial institution. It’s a place where members are treated like family, and their financial goals are taken seriously. Whether you're looking to save for your dream home, start a business, or simply manage your everyday expenses, Ardent Credit Union has got your back. Let’s dive deeper into what makes this credit union so special.

In today’s fast-paced world, having a financial partner you can trust is crucial. Ardent Credit Union delivers exactly that—trust, transparency, and value. As we explore the features, benefits, and services offered by Ardent Credit Union, you'll discover why it's become a go-to choice for so many individuals and families across the nation.

Read also:Fort Worth Botanic Garden A Nature Loverrsquos Paradise In Texas

Table of Contents

Membership Benefits at Ardent Credit Union

Ardent Credit Union's Financial Products

Savings Plans to Secure Your Future

Ardent Credit Union’s Community Impact

Read also:Delaware Seashore State Park Your Ultimate Guide To Beach Bliss

Embracing Technology for Member Convenience

How to Join Ardent Credit Union

Frequently Asked Questions About Ardent Credit Union

Conclusion: Why Choose Ardent Credit Union?

About Ardent Credit Union

Ardent Credit Union has been serving its members with dedication and integrity for decades. Founded with the mission to empower individuals through financial education and exceptional service, Ardent Credit Union continues to grow while staying true to its core values.

Unlike traditional banks, Ardent Credit Union operates as a not-for-profit organization. This means that any profits generated are reinvested back into the credit union to benefit its members. From lower interest rates on loans to higher dividends on savings accounts, Ardent Credit Union ensures that its members receive the best possible value.

But what really sets Ardent apart? It's the personal touch. Every member is treated with respect and care, and their unique financial situations are taken into account when providing advice and solutions. It’s no wonder Ardent Credit Union has built such a loyal and satisfied member base over the years.

History of Ardent Credit Union

The journey of Ardent Credit Union began in [year], with a vision to create a financial institution that prioritized people over profits. Over the years, it has evolved to meet the changing needs of its members, while always maintaining its commitment to excellence and community involvement.

Today, Ardent Credit Union serves thousands of members across multiple locations, offering a wide range of financial products and services. Its growth is a testament to its unwavering dedication to serving its members and supporting the communities it operates in.

Membership Benefits at Ardent Credit Union

Becoming a member of Ardent Credit Union comes with a host of benefits that traditional banks simply can’t match. Here’s a look at some of the perks you can enjoy as a member:

- Lower Fees: Say goodbye to excessive banking fees. Ardent Credit Union offers competitive pricing on all its services.

- Higher Interest Rates: Earn more on your savings with higher interest rates compared to traditional banks.

- Personalized Service: Get the attention and support you deserve with one-on-one consultations and tailored financial advice.

- Community Focus: Be part of a credit union that gives back to the community through various initiatives and programs.

These benefits, among many others, make Ardent Credit Union an attractive option for anyone looking to take control of their financial future.

Who Can Join Ardent Credit Union?

Membership at Ardent Credit Union is open to anyone who meets the eligibility criteria. Typically, this includes individuals who live, work, or worship in the areas served by the credit union. Additionally, family members of existing members may also qualify for membership.

Joining Ardent Credit Union is easy. All you need to do is open a basic savings account with a small deposit, and you’re officially a member. From there, you can access all the benefits and services offered by the credit union.

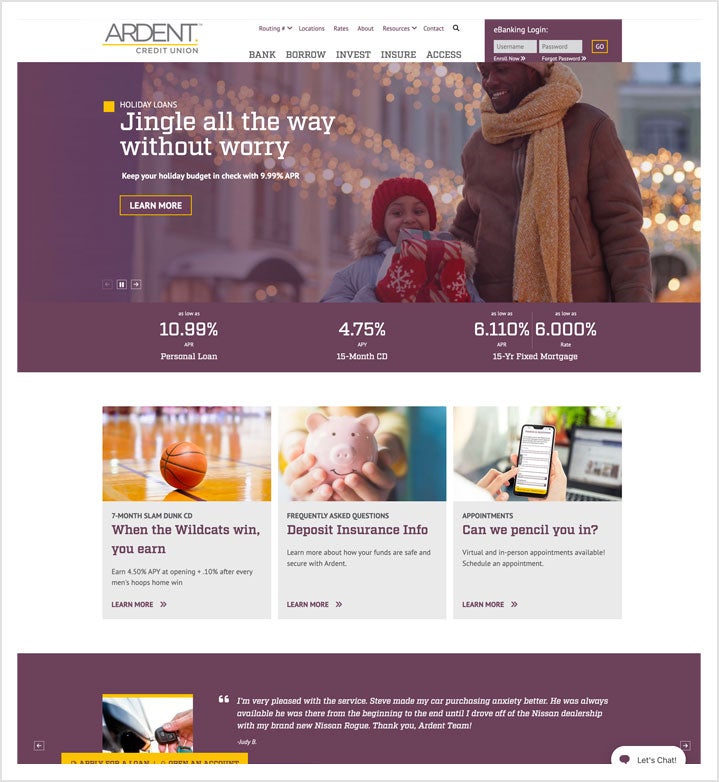

Ardent Credit Union's Financial Products

Ardent Credit Union offers a comprehensive suite of financial products designed to meet the diverse needs of its members. Whether you’re saving for a rainy day or investing in your future, Ardent has a product that suits your requirements.

Here’s a breakdown of the main financial products available:

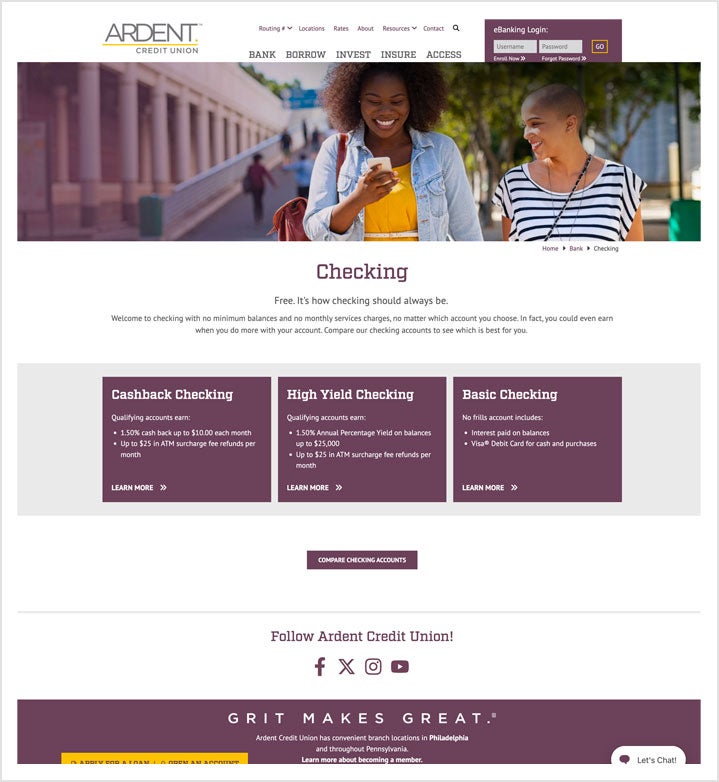

- Checking Accounts: Enjoy hassle-free banking with checking accounts that offer unlimited transactions and no hidden fees.

- Savings Accounts: Start building your nest egg with savings accounts that offer competitive interest rates.

- Certificates of Deposit (CDs): Lock in your savings with CDs that provide a guaranteed return on investment.

- Money Market Accounts: Combine the benefits of savings and checking accounts with money market accounts that offer higher interest rates.

Each product is designed to help you achieve your financial goals, whether short-term or long-term.

Innovative Solutions for Modern Needs

In addition to traditional financial products, Ardent Credit Union also offers innovative solutions that cater to the modern member. From digital banking services to mobile apps, Ardent ensures that its members have access to their accounts anytime, anywhere.

These digital tools make managing your finances easier than ever, allowing you to check balances, transfer funds, and pay bills with just a few clicks.

Loan Options for Every Need

Whether you’re buying a car, renovating your home, or consolidating debt, Ardent Credit Union offers a variety of loan options to suit your needs. With competitive interest rates and flexible terms, Ardent makes borrowing simple and affordable.

Here’s a look at some of the loan options available:

- Auto Loans: Get behind the wheel of your dream car with low-interest auto loans.

- Mortgage Loans: Secure your dream home with mortgage loans that offer competitive rates and flexible repayment options.

- Personal Loans: Access the funds you need for any purpose with personal loans that are easy to apply for and quick to approve.

- Home Equity Loans: Tap into the equity in your home to fund large purchases or renovations.

With Ardent Credit Union, you can rest assured that you’re getting the best deal on your loans, without compromising on quality or service.

Streamlined Application Process

Ardent Credit Union understands that applying for a loan can be a daunting process. That’s why they’ve streamlined their application process to make it as simple and stress-free as possible. Members can apply online, in-person, or over the phone, and receive a decision quickly.

Plus, with personalized guidance from Ardent’s experienced loan officers, you’ll have all the support you need to make an informed decision.

Savings Plans to Secure Your Future

Saving for the future is one of the most important financial decisions you can make. Ardent Credit Union offers a range of savings plans that help you achieve your goals, whether you’re saving for retirement, education, or a special occasion.

Some of the popular savings plans offered by Ardent include:

- Retirement Accounts: Plan for your golden years with IRAs and other retirement accounts that offer tax advantages.

- Education Savings Accounts: Invest in your child’s future with education savings accounts that grow over time.

- Special Occasion Savings: Set aside funds for weddings, vacations, or other special events with dedicated savings accounts.

With Ardent Credit Union, saving becomes a breeze, thanks to their user-friendly platforms and expert advice.

Maximizing Your Savings Potential

Ardent Credit Union goes the extra mile to help its members maximize their savings potential. Through financial education programs and one-on-one consultations, members gain the knowledge and tools they need to make informed decisions about their savings.

From budgeting tips to investment strategies, Ardent provides the resources necessary to help you achieve financial independence.

Ardent Credit Union’s Community Impact

Ardent Credit Union is more than just a financial institution—it’s a pillar of the community. Through various initiatives and programs, Ardent actively contributes to the betterment of the communities it serves.

Some of the ways Ardent Credit Union impacts the community include:

- Charitable Donations: Supporting local charities and organizations that work towards social and economic development.

- Financial Education Programs: Offering workshops and seminars to educate individuals about personal finance and money management.

- Community Events: Hosting events that bring people together and promote community spirit.

By giving back to the community, Ardent Credit Union reinforces its commitment to making a positive difference in the lives of its members and beyond.

Empowering Through Education

One of Ardent Credit Union’s key focuses is financial education. They believe that empowering individuals with knowledge is the first step towards financial independence. Through workshops, online resources, and one-on-one counseling, Ardent helps its members develop the skills and confidence needed to manage their finances effectively.

This commitment to education sets Ardent apart from other financial institutions and highlights its dedication to long-term member success.

Embracing Technology for Member Convenience

In today’s digital age, convenience is key. Ardent Credit Union understands this and has embraced technology to enhance the member experience. From online banking platforms to mobile apps, Ardent ensures that its members have access to their accounts whenever and wherever they need.

Some of the technological advancements offered by Ardent include:

- Mobile Banking: Check balances, transfer funds, and pay bills on the go with the Ardent mobile app.

- Online Bill Pay: Simplify your life with automatic bill payments that save you time and effort.

- ATM Network: Access your cash at thousands of ATMs nationwide without worrying about fees.

With these tools at your fingertips, managing your finances has never been easier.

Staying Secure in a Digital World

While technology offers many conveniences, it also comes with risks. Ardent Credit Union takes security seriously and employs state-of-the-art measures to protect its members’ information. From encryption protocols to two-factor authentication, Ardent ensures that your data remains safe and secure.

Members can rest assured that their accounts are protected, allowing them to focus on what matters most—achieving their financial goals.

Your Security Is Our Priority

Security is a top priority at Ardent Credit Union. With increasing threats in the digital landscape, Ardent has implemented robust measures to safeguard its members’ information and assets.

Some of the security features offered by Ardent include:

- Identity Theft Protection: Protect yourself from identity theft with comprehensive protection services.

- Fraud Monitoring: Stay alert with real-time fraud monitoring and alerts that notify you of suspicious activity.

- Secure Login: Access your accounts securely with multi-factor authentication and encrypted connections.

With Ardent Credit Union, you can bank with confidence, knowing that your security is never compromised.

Member Peace of Mind

Ardent Credit Union understands that security is a concern for many members. That’s why they go above and beyond to ensure that every transaction is safe and secure. By staying ahead of emerging threats and continuously updating their security protocols, Ardent provides its members with the peace of mind they deserve.

This commitment to security is just one more reason why Ardent Credit Union stands out as a trusted financial partner.

How to Join Ardent Credit Union

Ready to become a member of Ardent Credit Union? The process is simple and straightforward. Here’s how you can join:

- Check Eligibility: Verify that you meet the eligibility criteria for membership. This usually involves living, working, or

Article Recommendations