Whitefish Credit Union: Your Trusted Financial Partner For Growth And Security

Whitefish Credit Union is more than just a financial institution; it’s a community-driven powerhouse designed to empower individuals and businesses alike. If you’re looking for a place where your money grows, your dreams become reality, and your financial future feels secure, this is the perfect destination. Whether you’re saving for retirement, planning a home purchase, or simply managing daily expenses, Whitefish Credit Union offers tailored solutions to meet your needs.

Let’s be real here—finding the right financial partner can feel overwhelming. There’s so much jargon, endless options, and sometimes even hidden fees that make you question if you’re really getting the best deal. That’s why Whitefish Credit Union stands out. They focus on YOU—their members—and ensure that every service, product, and interaction is built with transparency and trust in mind.

So, whether you’re new to credit unions or have been part of one for years, this article will dive deep into what makes Whitefish Credit Union special. From their history and mission to the services they offer, we’ll cover everything you need to know. Plus, we’ll throw in some tips and tricks to help you make the most of your membership. Let’s get started!

Read also:My Vampire System Unlocking The Secrets Of A Unique Roleplaying Adventure

Table of Contents

- Introduction to Whitefish Credit Union

- The Rich History of Whitefish Credit Union

- Becoming a Member: Who Can Join?

- Services Offered by Whitefish Credit Union

- Loan Options Tailored for You

- Savings Accounts That Work for You

- Embracing Technology for Better Banking

- Community Involvement and Impact

- Why Choose Whitefish Credit Union?

- Tips for Maximizing Your Membership

Introduction to Whitefish Credit Union

Alright, let’s break it down. Whitefish Credit Union isn’t just another bank. It’s a member-owned cooperative that operates with the sole purpose of helping its members succeed financially. Unlike traditional banks, credit unions like Whitefish prioritize their members over profits. This means lower fees, better interest rates, and personalized service. And guess what? They’ve been doing this for decades.

One of the coolest things about Whitefish Credit Union is their commitment to the local community. They’re not just about numbers; they’re about people. Their mission is to provide financial education, support small businesses, and offer products that help members achieve their goals. So, whether you’re saving for a dream vacation or starting a business, they’ve got your back.

What Sets Credit Unions Apart?

Here’s a quick rundown of why credit unions are different from traditional banks:

- Member-Driven: Credit unions are owned by their members, meaning decisions are made with the best interests of members in mind.

- Lower Fees: Typically, credit unions charge fewer and lower fees compared to big banks.

- Higher Interest Rates: You’ll often find better rates on savings accounts, CDs, and loans at credit unions.

- Personalized Service: Credit unions pride themselves on knowing their members by name and offering tailored solutions.

The Rich History of Whitefish Credit Union

Whitefish Credit Union has a storied past that dates back to [insert founding year]. It all started as a small group of individuals who wanted to create a financial institution that prioritized people over profits. Over the years, the credit union has grown significantly, expanding its services and reach while staying true to its core values.

Today, Whitefish Credit Union serves thousands of members across [insert region]. Their dedication to innovation, community involvement, and financial education has earned them a reputation as a leader in the credit union space. But don’t just take our word for it—numerous awards and testimonials from satisfied members speak volumes about their impact.

Key Milestones in Whitefish Credit Union’s History

Let’s take a look at some of the major milestones that have shaped Whitefish Credit Union:

Read also:Discover The Best Fruteria Near Me Your Ultimate Guide To Freshness

- [Year]: The credit union was officially established with a handful of founding members.

- [Year]: Introduced their first line of consumer loans, revolutionizing how members accessed credit.

- [Year]: Expanded their branch network to better serve the growing membership base.

- [Year]: Launched their online banking platform, making banking more convenient than ever.

Becoming a Member: Who Can Join?

So, how do you become part of the Whitefish Credit Union family? Membership is open to anyone who meets specific criteria, which usually includes living, working, worshiping, or attending school in the credit union’s service area. In many cases, family members of existing members can also join.

Joining is simple—just visit a branch or apply online. Once you’re a member, you’ll gain access to a wide range of services and benefits. And remember, when you join a credit union, you’re not just opening an account; you’re becoming a shareholder in a cooperative that works for you.

Benefits of Membership

Here are just a few perks of being a Whitefish Credit Union member:

- No Hidden Fees: Transparency is key, so you’ll always know exactly what you’re paying for.

- Competitive Rates: Enjoy better rates on loans and higher returns on savings accounts.

- Financial Education: Access workshops, webinars, and resources to improve your financial literacy.

- Community Focus: Be part of an organization that gives back to the community.

Services Offered by Whitefish Credit Union

Whitefish Credit Union offers a wide array of services designed to meet the diverse needs of their members. From checking accounts to retirement planning, they’ve got you covered. Let’s explore some of the key services they provide:

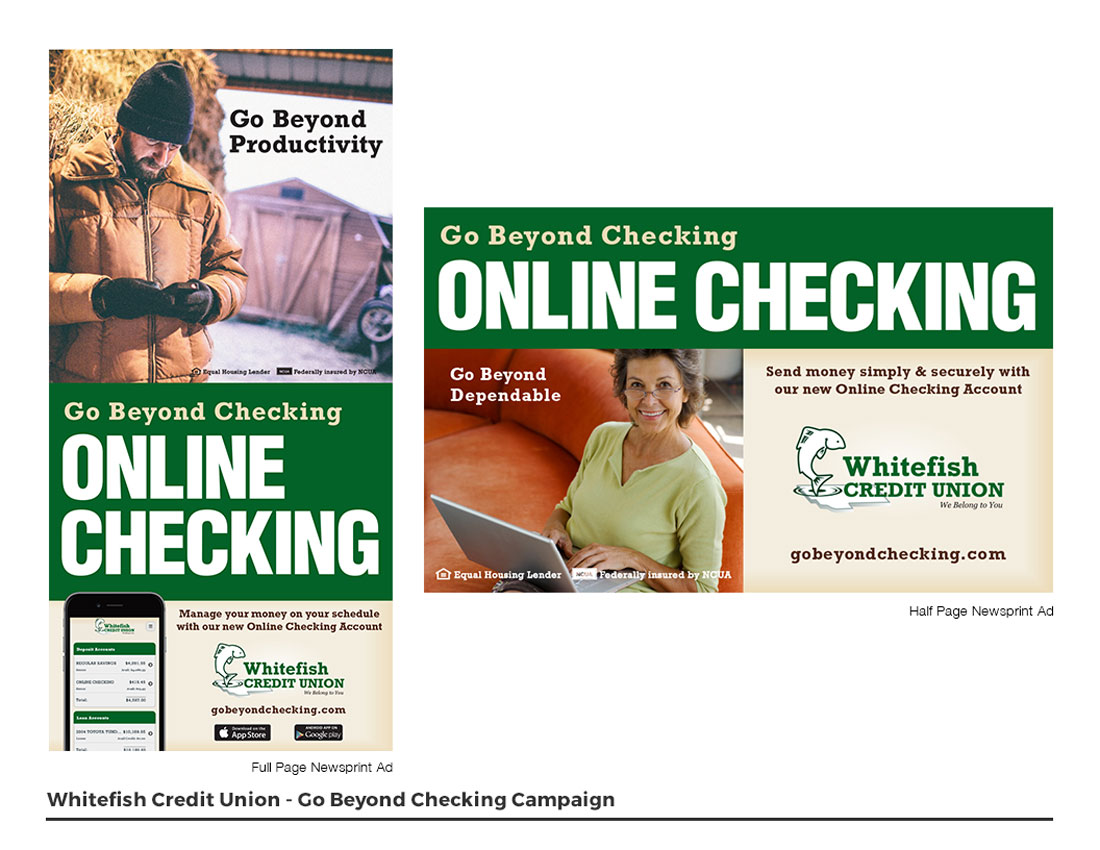

Checking Accounts

Need a reliable place to store your money and pay bills? Whitefish Credit Union offers several types of checking accounts, including free checking options for those who qualify. With features like mobile check deposit and bill pay, managing your finances has never been easier.

Savings Accounts

Saving for the future is important, and Whitefish Credit Union makes it easy with competitive interest rates and no minimum balance requirements. Whether you’re building an emergency fund or saving for a big purchase, their savings accounts are designed to help you reach your goals.

Certificates of Deposit (CDs)

If you’re looking for a low-risk way to grow your money, consider opening a CD with Whitefish Credit Union. These accounts offer fixed interest rates for a set term, making them a great option for long-term savings.

Loan Options Tailored for You

Whether you’re buying a car, remodeling your home, or consolidating debt, Whitefish Credit Union offers a variety of loan options to suit your needs. Their loan products are designed to provide flexibility, competitive rates, and personalized service.

Auto Loans

Need a new ride? Whitefish Credit Union offers auto loans with competitive rates and flexible terms. Plus, they’ll work with you to find the best financing solution for your budget.

Mortgage Loans

Buying a home is one of the biggest financial decisions you’ll make, and Whitefish Credit Union is here to help. With a range of mortgage options and expert guidance, they’ll ensure you find the perfect loan for your dream home.

Personal Loans

From debt consolidation to unexpected expenses, personal loans from Whitefish Credit Union can help you tackle life’s challenges. With quick approval and affordable payments, these loans are a great option for short-term financial needs.

Savings Accounts That Work for You

Saving money doesn’t have to be complicated. Whitefish Credit Union offers several savings account options designed to help you achieve your financial goals. Whether you’re saving for a rainy day or planning for retirement, their accounts are built to help you succeed.

One of the standout features of their savings accounts is the ability to set up automatic transfers, making it easy to save without even thinking about it. Plus, with no hidden fees and competitive interest rates, you can rest assured that your money is working for you.

How to Maximize Your Savings

Here are a few tips for getting the most out of your Whitefish Credit Union savings account:

- Set Clear Goals: Whether it’s a vacation or a down payment, having a goal in mind can help you stay motivated.

- Automate Transfers: Schedule regular transfers from your checking to savings account to build your balance over time.

- Monitor Your Progress: Keep an eye on your account to see how close you’re getting to your goals.

Embracing Technology for Better Banking

In today’s digital age, convenience is key. Whitefish Credit Union understands this and has invested heavily in technology to make banking easier for their members. From mobile banking apps to online bill pay, they’ve got tools to help you manage your finances anytime, anywhere.

One of the coolest features of their mobile app is the ability to deposit checks remotely using your smartphone. No more trips to the branch—just snap a picture, upload, and you’re done. Plus, their app offers real-time account updates, so you’re always in control of your money.

Security Measures

With all this technology comes the need for robust security measures. Whitefish Credit Union uses state-of-the-art encryption and multi-factor authentication to protect your information. So, whether you’re banking online or using the app, you can rest assured that your data is safe.

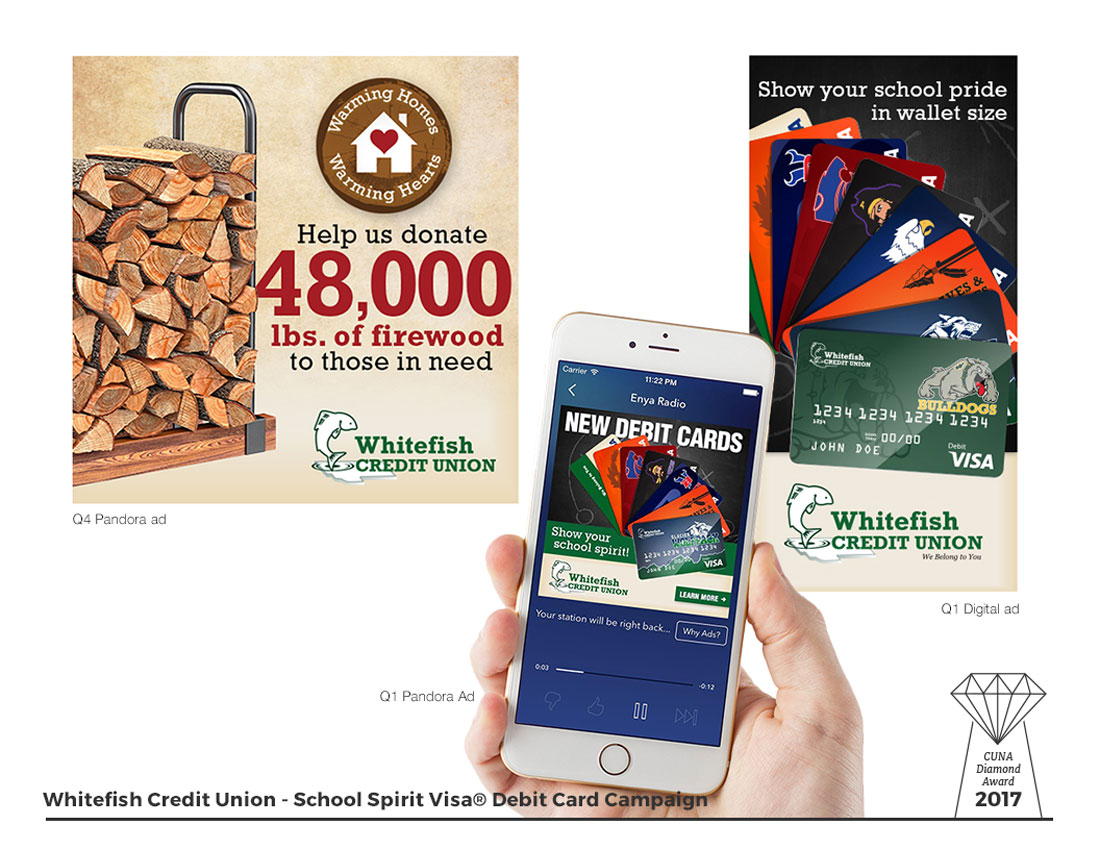

Community Involvement and Impact

Whitefish Credit Union isn’t just about numbers—they’re about people. They’re deeply involved in the communities they serve, supporting local organizations, charities, and events. Through their commitment to social responsibility, they’re helping to build stronger, more prosperous communities.

One of their signature initiatives is their financial literacy program, which provides free workshops and resources to help individuals improve their money management skills. From budgeting to investing, they offer tools and guidance to empower people to take control of their financial futures.

How You Can Get Involved

If you’re passionate about giving back, consider getting involved with Whitefish Credit Union’s community programs. They’re always looking for volunteers to help with events, workshops, and outreach efforts. Plus, as a member, you can take pride in knowing that your membership supports these important initiatives.

Why Choose Whitefish Credit Union?

When it comes to choosing a financial institution, the options can seem endless. So, why should you choose Whitefish Credit Union? Here are just a few reasons:

- Member Focus: Your needs and goals are at the heart of everything they do.

- Competitive Rates: Enjoy better rates on loans and higher returns on savings accounts.

- Personalized Service: Get the attention and support you deserve from knowledgeable staff.

- Community Impact: Be part of an organization that gives back to the community.

Tips for Maximizing Your Membership

Now that you know all about Whitefish Credit Union, here are a few tips to help you make the most of your membership:

- Take Advantage of Financial Education: Attend workshops and webinars to improve your financial literacy.

- Use Online and Mobile Banking: Simplify your life by managing your accounts from anywhere.

- Explore Loan Options: Whether you’re buying a car or refinancing your home, explore the loan products that fit your needs.

- Stay Connected: Follow Whitefish Credit Union on social media to stay up-to-date on news, promotions, and events.

Conclusion

Whitefish Credit Union is more than just a financial institution—it’s a partner in your financial journey. From their rich history and commitment to the community to their wide range of services and personalized approach, they offer everything you need to succeed financially. So, whether you’re saving for the future, planning a major purchase, or simply managing your day

Article Recommendations