Unlocking The Power Of JPMCB Card Services: Your Ultimate Guide

Listen up, folks! If you're here, chances are you're looking to dive deep into the world of jpmcb card services and figure out what all the fuss is about. Whether you're a first-timer or already knee-deep in the credit card game, this guide is your golden ticket to understanding everything from the basics to the advanced features. Let's get this party started, shall we?

Now, before we jump into the nitty-gritty, let's set the stage. JPMCB Card Services is not just another player in the financial world; it's a powerhouse that's been making waves for a while now. If you're curious about how this service can benefit you or if you're just trying to wrap your head around the concept, you're in the right place.

So, grab a coffee, get comfy, and let's break down what jpmcb card services has to offer. By the end of this, you'll be walking away with a solid understanding of how these services can impact your financial life. Let's rock!

Read also:Uolta Political Stance Where Does The Beauty Giant Stand

Here's a quick rundown of what we'll cover:

- What is JPMCB Card Services?

- History and Background

- Key Features of JPMCB Card Services

- Types of Cards Offered

- Benefits and Advantages

- Eligibility Requirements

- Application Process

- Customer Support

- Security and Privacy

- User Experience

What is JPMCB Card Services?

Alright, let's start with the basics. JPMCB Card Services is a division of JPMorgan Chase Bank, one of the largest financial institutions globally. It provides a wide array of credit card services tailored to meet the diverse needs of its customers. From everyday spending to luxury travel, jpmcb card services has something for everyone.

Here's the deal: these services aren't just about giving you a piece of plastic to swipe around. They're designed to offer convenience, security, and a host of perks that can make your financial life a whole lot easier.

Why Choose JPMCB Card Services?

There are plenty of reasons why people opt for jpmcb card services. For starters, the reputation of JPMorgan Chase speaks for itself. But beyond that, the personalized services, robust security measures, and excellent customer support make it a top choice for many.

History and Background

Let's take a trip down memory lane. JPMorgan Chase Bank, the parent company of JPMCB Card Services, has a rich history that dates back over 200 years. Founded in 1799 as The Bank of the Manhattan Company, it has evolved into one of the leading financial services firms worldwide.

Over the years, JPMorgan Chase has acquired several other banks and financial institutions, expanding its reach and capabilities. JPMCB Card Services, as part of this legacy, continues to innovate and adapt to the ever-changing financial landscape.

Read also:Jr Ridinger Died The Legacy And Impact Of A True Wrestling Legend

Key Features of JPMCB Card Services

Now, let's talk about what makes jpmcb card services stand out. Here are some of the key features you can expect:

- Competitive interest rates

- Generous rewards programs

- Advanced fraud protection

- Global acceptance

- 24/7 customer support

These features are designed to provide a seamless and secure financial experience for users.

How Do These Features Benefit You?

Each of these features plays a crucial role in enhancing your financial well-being. For instance, competitive interest rates mean you save money on finance charges, while advanced fraud protection ensures your transactions are safe from unauthorized access.

Types of Cards Offered

JPMCB Card Services offers a variety of cards to suit different lifestyles and financial goals. Here's a quick overview:

- Chase Sapphire Preferred® Card – Ideal for travel enthusiasts

- Chase Freedom Unlimited® – Great for everyday spending

- Chase Ink Business Preferred Credit Card – Perfect for small business owners

No matter your financial situation or goals, there's likely a card that fits your needs.

Choosing the Right Card

Selecting the right card can be overwhelming, but it doesn't have to be. Consider your spending habits, travel plans, and financial goals when making your decision. And don't forget to read the fine print to understand any fees or restrictions.

Benefits and Advantages

Let's dive into the benefits of using jpmcb card services. From cashback rewards to travel perks, there's a lot to love:

- Cashback rewards on everyday purchases

- Travel benefits like airport lounge access and travel credits

- Zero liability for unauthorized transactions

- Access to exclusive events and experiences

These benefits can add up to significant savings and enhance your overall lifestyle.

Maximizing Your Benefits

Knowing how to maximize your benefits is key to getting the most out of your card. Use your card for everyday expenses, take advantage of travel perks, and always keep an eye out for special offers or promotions.

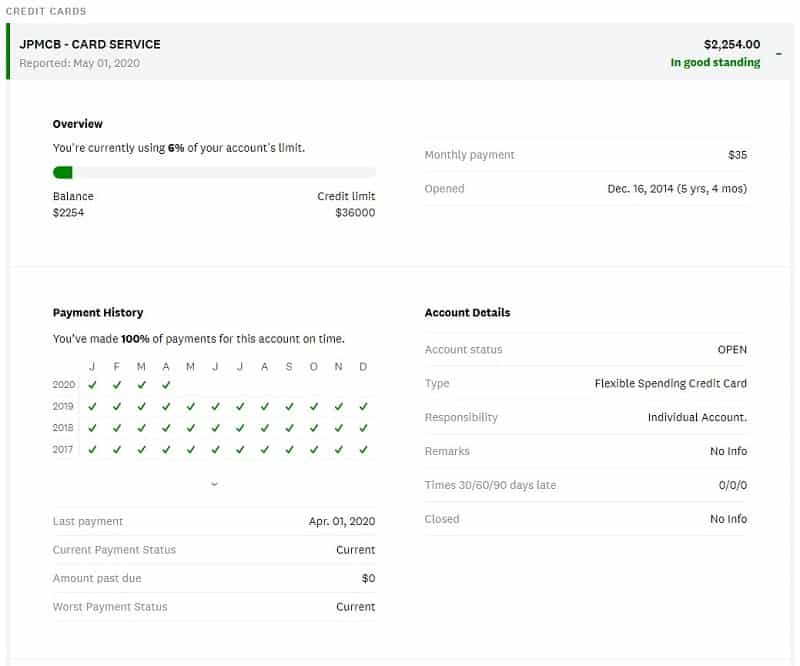

Eligibility Requirements

Before you apply for a card, it's essential to understand the eligibility requirements. Generally, you'll need:

- A good credit score

- Proof of income

- U.S. residency

While these requirements may vary slightly depending on the card, having a strong credit history is crucial.

Tips for Improving Your Eligibility

If you're not quite there yet, don't worry. There are steps you can take to improve your eligibility:

- Pay your bills on time

- Keep your credit utilization low

- Monitor your credit report for errors

By taking these steps, you'll be well on your way to meeting the requirements for jpmcb card services.

Application Process

Ready to apply? The process is straightforward and can be done online in just a few minutes. Here's what you need to do:

- Visit the official website

- Choose the card that suits your needs

- Fill out the application form with your personal and financial information

- Submit your application and wait for a decision

Once approved, your card will be on its way, and you'll be ready to start enjoying the benefits.

What Happens After Approval?

After approval, you'll receive your card in the mail. Be sure to activate it immediately and set up any necessary security features, like text alerts or mobile app access. This ensures you're ready to start using your card safely and securely.

Customer Support

Customer support is a critical component of any financial service, and JPMCB Card Services doesn't disappoint. Here's what you can expect:

- 24/7 access to support via phone or online chat

- Help with account management and troubleshooting

- Resources for financial education and planning

Having access to reliable support can make all the difference when you're dealing with financial matters.

How to Reach Out

Whether you have a question about your account or need help with a transaction, reaching out is easy. Simply visit the website, call the customer service number, or use the mobile app to connect with a representative.

Security and Privacy

Security is a top priority for JPMCB Card Services. With features like chip technology, fraud monitoring, and secure login options, your information is protected at every turn.

Plus, the zero liability policy ensures you're not held responsible for unauthorized transactions, giving you peace of mind.

Protecting Your Information

While JPMCB Card Services takes security seriously, there are steps you can take to protect your information:

- Use strong, unique passwords

- Be cautious when using public Wi-Fi

- Regularly monitor your account for suspicious activity

By staying vigilant, you can help safeguard your financial information.

User Experience

Finally, let's talk about the user experience. Most customers report a positive experience with jpmcb card services, citing ease of use, excellent customer support, and valuable rewards as standout features.

Of course, like with any service, your experience may vary. But with a commitment to quality and innovation, JPMCB Card Services continues to set the standard in the financial industry.

Final Thoughts

So, there you have it – a comprehensive look at jpmcb card services. Whether you're looking for a card to help with everyday expenses or one that offers luxurious travel perks, there's something for everyone.

Now it's your turn. If you've found this guide helpful, feel free to leave a comment or share it with a friend. And if you're ready to take the next step, head over to the official website and start your application today. Your financial future is just a click away!

Article Recommendations